By Chuin Ting Weber, CFP, CFA, CAIA

CEO & Chief Investment Officer, MoneyOwl

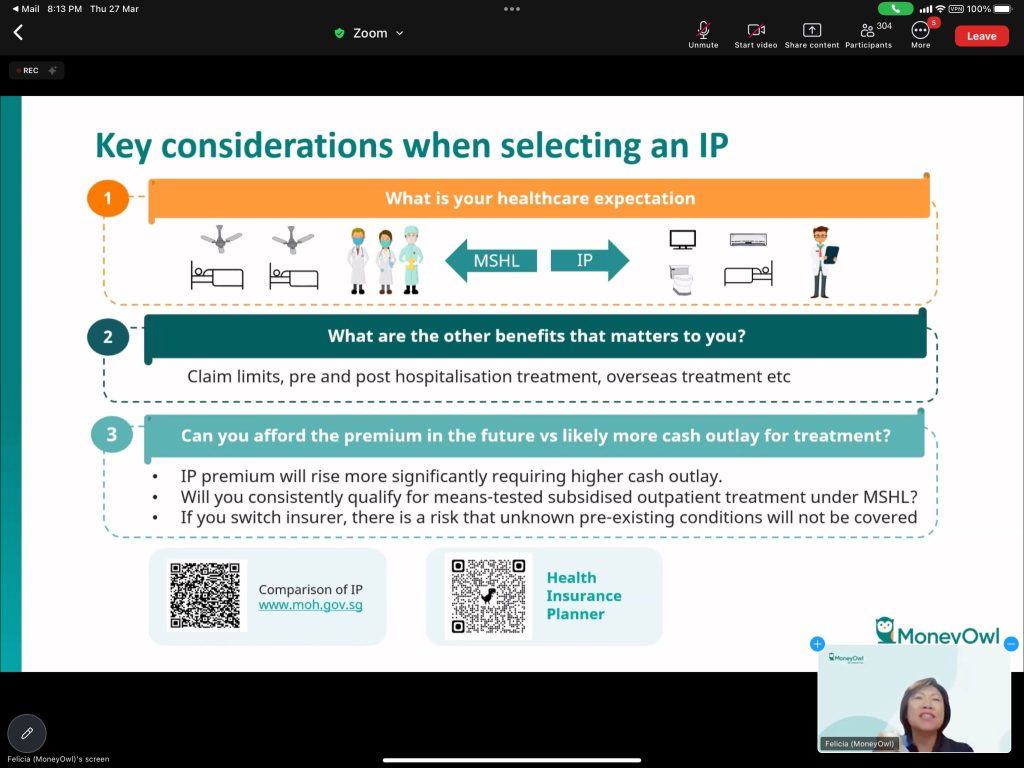

MoneyOwl’s webinar on health insurance by our Master Trainer Felicia Yeo this evening coincided with the launch of the CPF Health Planner today by MOH and CPF Board.

The tool shows costs of health insurance over time and compares plan prices.

Indeed Integrated Shield Plans (IP), especially riders, go up in cost.

But as Felicia said, please do not just compare on the basis of cost.

1️⃣ It is VERY important that you try not to switch insurer on this basis – the relative ranking of cost can change from year to year, age band to age band.

More importantly, some illnesses have no symptoms.

If you switch and suddenly you have a claim, you could get denied if medically your condition was deemed to have be pre-existing at time of insuring – whether or not you knew it.

If you want to downgrade because of cost, do it with the same insurer.

2️⃣ Please don’t go out and cancel your IP without thinking through.

Not a decision to be taken lightly.

Insurance is an expense.

It needs to be fit-for-purpose: within your means, but not necessarily to be avoided or minimised.

You need to ensure that you are consistently able to claim subsidised care – note that means testing for dialysis, for example, applies and if you don’t qualify, you would miss having an IP.

If you need to cancel for costs, consider the option of keeping the main IP or a lower-level IP while cancelling the rider, instead of cancelling the whole thing.

Riders are probably the one that may not be such value-for-money, as Medisave can be used to pay for some of the deductible and co-insurance, up to limits.

3️⃣Finally, the increasing cost of IPs tells that we need to build cash retirement income.

Health insurance premium is one cost we have to factor into our retirement expenses because it is a lifelong need.

To have enough money to do so, don’t overpay for income-replacement type of insurance – consider term insurance, so you have funds left over to top up CPF for a higher CPF LIFE payout or to invest for a good return.

⭐️ And… keep healthy in body and mind!

Having a good financial plan helps with peace of mind.

It’s all integrated indeed!

Thanks to the 300+ friends who joined us.