Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Personal Accident plans, If you are thinking that this sounds like an attractive product to take up now, think again.

With the circuit breaker measures extended till 1 June, checking for daily updates on a number of COVID-19 cases has become a norm for many of us working from home. If you are waiting for the daily updates and are scanning your device for something, here’s something for you.

When COVID-19 first hit our shores, one of the immediate questions that many people have was whether their insurance covered them should they get infected with the virus. If you have been following our Facebook, you would have come across this summary.

What this means is that should death occur as a result of COVID-19, your insurance will pay. However, the mortality rate for this virus is low. As of publishing, we are looking at a 0.08% mortality rate in Singapore (12 deaths out of 14,423 confirmed cases on 27 April 2020). As such this should be of little concern to you.

Your hospitalisation insurance, whether a private plan or a MediSave approved insurance would also pay for your medical expenses should you require treatment in a hospital as a result of the virus. Given that the treatment duration for COVID-19 is potentially long-drawn, this gives us much assurance that our medical bills will be taken care of.

However, most hospitalisation plans today have co-payment features which means that you might still need to bear some costs yourself and this could still pose some financial difficulty for those with little MediSave (e.g. homemakers and students). In addition, for those whose income depends on them being well enough to work (i.e. freelancers, contract workers), this is small comfort because it does nothing to replace their income. Unlike an employee who is entitled to paid medical and hospitalisation leave.

So should I get a Personal Accident (PA) Plan?

To fill the gap for these groups of people, enter a category of insurance called Personal Accident (PA) plans. PA are low-cost alternatives that in the event of an accident, provide death and disability coverage, medical reimbursements from the first dollar and may include loss of income benefits for hospitalisation or temporary disablement.

If you are thinking that this sounds like an attractive product to take up now, think again. PA may or may not be suitable for you depending on what you are looking for.

1. If you intend to get a Personal Accident Plan only for COVID-19

As mentioned, both death and hospitalisation benefit are already provided for under your life insurance and hospitalisation plan respectively. There is a little incremental benefit to get COVID-19 cover offered under PA.

Not only are the benefits minimal due to high underwriting risk, having high coverage for COVID-19 might lead to moral hazards in current climate ala “I’m insured so I can go outside and jalan jalan (read: walk around)”. For your information, insurance will not pay your fine for breaking the circuit breaker measures.

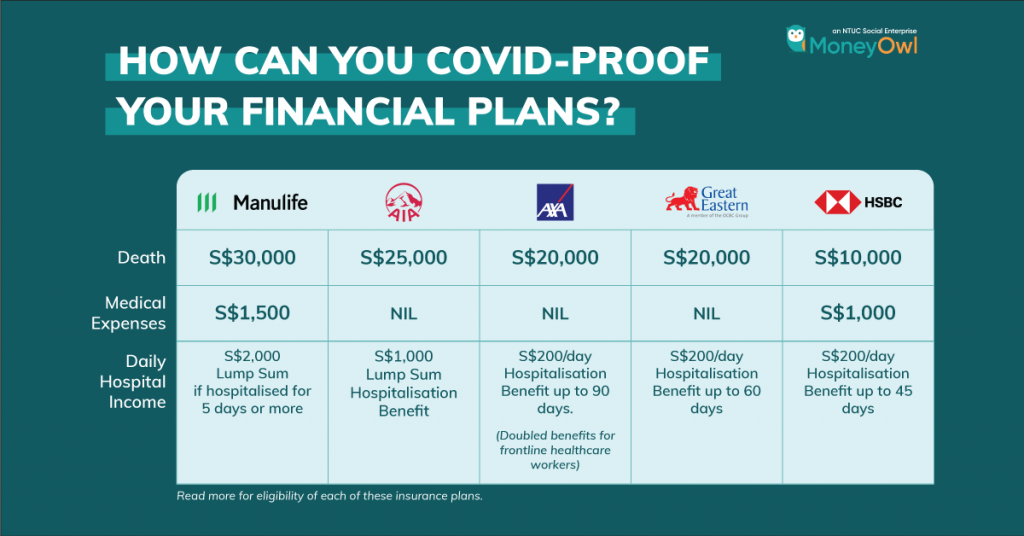

What’s more, based on our research, some insurers out of goodwill will extend COVID-19 coverage temporarily to you as long as you hold a policy of any type with them. Here is what some insurers are providing their clients free of charge.

2. If you intend to get a Personal Accident Plan as your ONLY insurance plan

PA plans generally provide coverage for events that are more common and are typically not covered under the core insurance plans. Due to the ease with which one can claim from a PA plan (I have claimed thrice through a family PA plan), it is easily sold as we can always relate to the possibility of accidents like falls and contracting infectious diseases like dengue or Hand Foot and Mouth Disease.

Without a co-payment feature that most hospitalisation plans have, you can almost always claim for medical expenses, mobility aids and diagnostic tests from the first dollar. The disability claim is also more lenient compared to the Total and Permanent Disability which follows a stringent criterion. You can still claim for a portion of the disability payout based on a table of benefits, i.e. loss of a finger.

The crux though is that claim is only possible if it resulted from an accident or contraction of infectious disease within the list covered by the insurer. What this means is if death or disability was due to any other cause, this plan is effectively useless. With close to 80% of deaths in Singapore caused by critical illnesses (cancer, heart attack, pneumonia etc.) rather than from accidents, you would be leaving you and your family’s protection needs exposed with only a PA plan.

3. If you intend to get a Personal Accident Plan to boost your existing coverage

It is always good to have more than less protection and to ensure that we have all our bases covered down to the last possible negative event. However, it is also important to look at how much you are spending on your insurance coverage relative to surpluses available to meet your life goals. This is often overlooked when you look at your financial plans through a single lens.

In the context of risk management, there are four ways to manage risk – accept/retain, avoid, reduce and transfer. Insurance is an instrument used to transfer risk to another party especially for catastrophic events where it would be too much for an individual to accept the risk fully. Put into perspective, if you had an additional $1, would you rather allocate that dollar towards achieving your life goals or protect against an event that you are likely able to retain the risk yourself?

If you have found more questions than answers from this article, why not use this period of Great Lockdown as a time for Great Reflection? With the slew of tools online and well as contactless communication channels available with MoneyOwl, you can easily find the answers from the comforts of home. Come talk to us about your financial concerns.

In conclusion, do not just look at PA plans.

- If you are looking to be covered for COVID-19, don’t buy a PA plan just for this. High chance that your life and hospitalisation insurance plans will cover you sufficiently for it.

- If you are looking to boost your insurance coverage, always good to cover more grounds especially if you are accident prone or fall into one of the categories of people mentioned above. However, make sure that your core plans are first in place. Check out our Young Working Adults bundle on a low-cost way to do so.

- If do not believe in insurance at all, then why are you looking at PA plans? But if a PA is the one plan you’re willing to spend money on, then do so by all means as some coverage is better than none.