By Chuin Ting Weber, CFP, CFA, CAIA

CEO & Chief Investment Officer, MoneyOwl

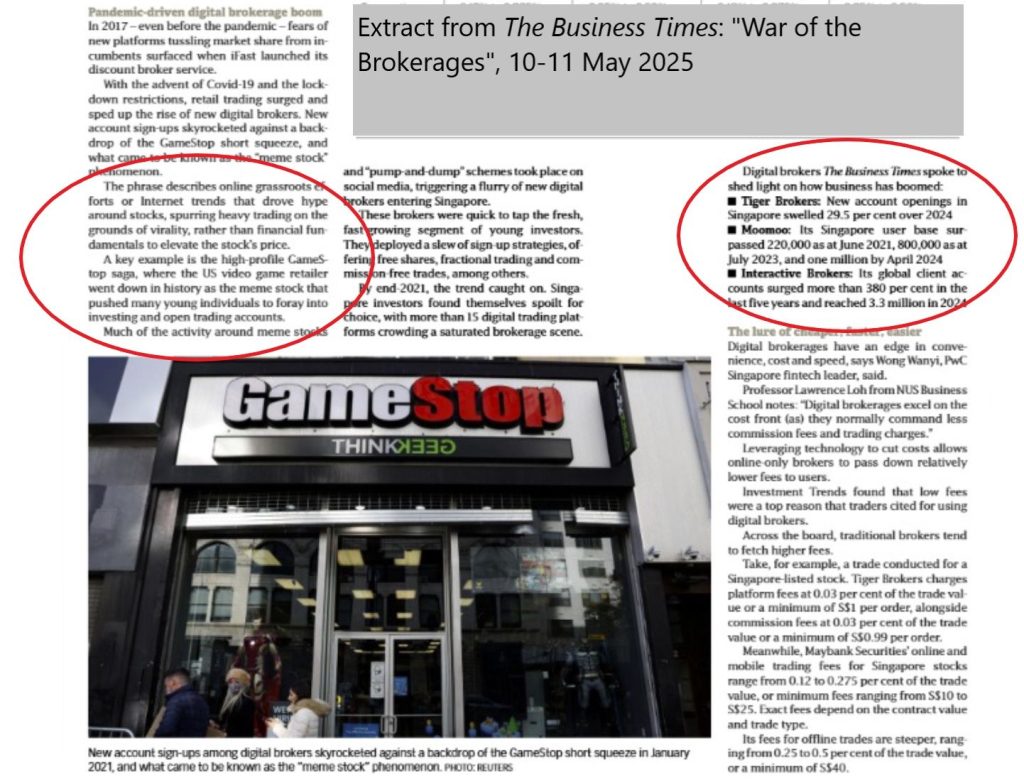

The Business Times reported last weekend that a digital brokerage now has 1 million Singaporean users.

Investing is no longer just for the wealthy—it’s accessible to all. That’s exciting and empowering.

But like fire, investing can either build or destroy—especially for everyday Singaporeans.

When your dollar is limited, mistakes hurt more.

Democratising access must thus come with democratising good advice.

That’s why, as a CEO/CIO of a social enterprise, I’ve been making short videos on issues like the Trump tariffs.

Because knowledge protects.

Check out my latest 3-min video in MoneyOwl’s social channels on the US-China tariff truce.