By Vivienne Ong

Marketing Lead, MoneyOwl

Budget 2025 has just passed, and it’s clear that there is one thing that is still weighing on the minds of Singaporeans – the high costs of living.

“Cost of living concerns go ‘far beyond’ GST; raising the tax not an easy choice: PM Wong”

While the payouts announced in Budget 2025 provide temporary relief, building long-term financial stability requires proactive and intentional measures.

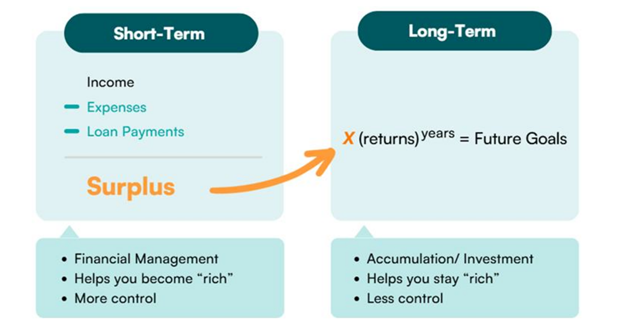

For this, understanding our Personal Money Equation is key in helping us to move forward with confidence:

We can improve our financial well-being by focusing on the “left side” of the Personal Money Equation.

1️⃣ Managing our Expenses

The rising prices may be discouraging, but understanding our spending habits and knowing exactly where our money goes can give us clarity and empower us to make changes that we did not realise are options.

For example – based on a YouGov survey in 2024, more than half of all consumers have at least one subscription that they haven’t used in the past six months.

Also, while new services like BNPL can help us afford large purchases and manage our cash flow when used wisely, they may also skew our perception of how much we are really spending.

This is because splitting up our spending into instalments may feel like we’re spending less, but it can quickly add up and lead to a debt trap if not managed carefully.

Small adjustments, like switching to more affordable meal options or reducing impulse purchases, can make a big difference over time.

Tools like BudgetMealGoWhere can help us find meals under $3, while buying in bulk maximises savings. MoneyOwl also has a budgeting rubric and tool to help you to keep spending in check.

2️⃣ Keeping Loan Payments under Control

Reducing debt is key, as paying high interest rates prevents us from saving for the future or spending on purposeful living. Start by paying off high-interest debts such as credit card debt. Read our guide on how you can better manage your debts here.

However, mortgage debt is generally considered “good debt” as it charges a lower interest rate and has a clear purpose of helping us own a home, which is an asset.

So, if you are paying off an HDB loan at 2.6% p.a. interest, consider investing the excess cash, rather than rushing to pay off the loan early for better returns and flexibility.

3️⃣ Growing our Income

Your Most Important Financial Asset is you – your ability to generate income.

This first item on the “left side” of the equation may seem hard to increase in the short term.

But to stay ahead in your career and generate more income, it’s essential to continuously upskill and keep up with industry trends, to ensure that you remain a valuable asset to the company.

For the longer term, the recent Budget 2025 continued to provide support for lifelong learning and upskilling.

New schemes include a new $300 monthly training allowance for selected part-time courses under the SkillsFuture Level-Up Programme. These complement programmes such as the Career Conversion Programmes, which help mid-career individuals switch to better job sectors with training and government support.

And while upskilling or changing your job may be uncomfortable and feel like a career pause, it’s a vital and necessary step to improve your financial situation and future.

You can increase your income, improve your employability and advance your career at a much faster rate.

4️⃣ Optimising our Insurance Coverage

As you review your spending, do you find that you are spending a significant amount of your pay on insurance?

Insurance is essentially for protection and should be used to transfer away major life risks that lead to loss of income (your Most Important Financial Asset on the “left side” of the Personal Money Equation) and large healthcare costs.

It is an expense, also part of this “left side”, and we should aim to spend as little as possible while getting as much coverage as we need. MAS’ Basic Financial Planning Guide recommends us to spend not more than 15% of our income on insurance protection.

MoneyOwl recommends using cost-effective term insurance for these situations, and we avoid using insurance for both protection and saving/investing due to insufficient returns and coverage, as well as high costs.

Take the time to review your insurance plans and consult a financial adviser to avoid overpaying while still meeting protection needs.

You can also refer to MoneyOwl’s OwlInsure to get a gauge on how much insurance coverage is ideal for you based on your life stage.

On the “right side” of the Personal Money Equation, we focus on investing for the long term.

Investing helps secure our financial future without sacrificing our present. Focus on building wealth through:

✅ Prioritising sufficient and reliable returns over chasing the highest gains

✅ Staying globally diversified across different markets

✅ Avoiding market timing – it’s about time in the market, not timing the market

✅ Keeping investment costs low – every dollar saved on fees is a dollar that stays invested and compounds over time

If you’re not sure where to start, explore OwlInvest, where we have curated investment solutions that are passive, globally diversified and low-cost.

With the right approach, we can let our money work harder, while we focus on living life.