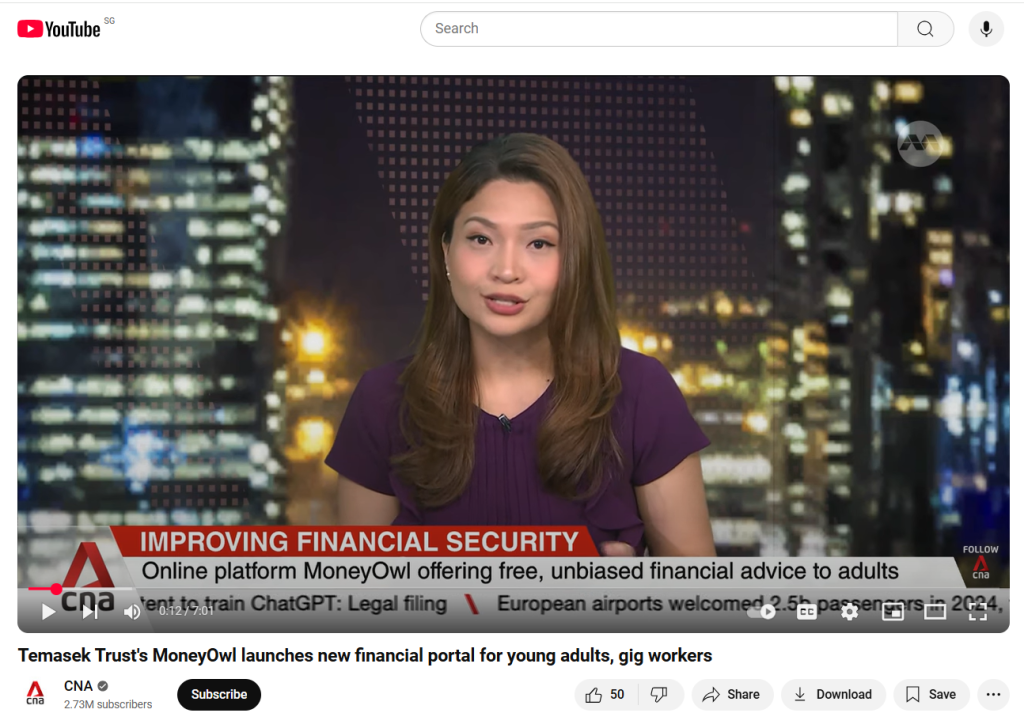

A new online portal is offering free advice to help Singaporeans plan their finances. The initiative by social enterprise MoneyOwl and Temasek Trust is focusing on the under-served segments of society, like young working adults, as well as shift and gig workers. To reach shift workers who are mostly on the move, bite-sized financial tips will be sent to them through WhatsApp. Mrs Chuin Ting Weber, chief executive officer and chief investment officer of MoneyOwl, shared how the financial portal differs from others.

Temasek Trust’s MoneyOwl launches new financial portal for young adults, gig workers

MoneyOwl on Channel News Asia

12 February 2025

More of MoneyOwl in the Media

Stay informed on our latest updates and happenings.

Daphne Lye, Senior Solutions Lead of MoneyOwl, pointed out that the Central Provident Fund (CPF) is the cornerstone of Singapore’s retirement planning. The CPF-related adjustments that will take effect next year can help Singaporeans increase their retirement savings.

24 Dec 2025

In The News

Daphne Lye, Financial Planning Lead at MoneyOwl, said that when evaluating existing insurance plans, one should consider whether adjustments are necessary based on the new environment and life goals. The important thing is to ensure that one and one’s family do not pay excessive premiums but receive adequate protection. She provides the following basic insurance guidelines:...

21 Nov 2025

In The News

Chuin Ting Weber, CEO and CIO of MoneyOwl, encouraged early retirement planning and CPF top-ups. The earlier you start retirement planning, the better. She suggested that the public start by understanding their existing CPF savings and setting a target monthly income for retirement. They should also set a certain amount to invest or top up their...

25 Oct 2025

In The News