MoneyOwl's

Retirement Philosophy:

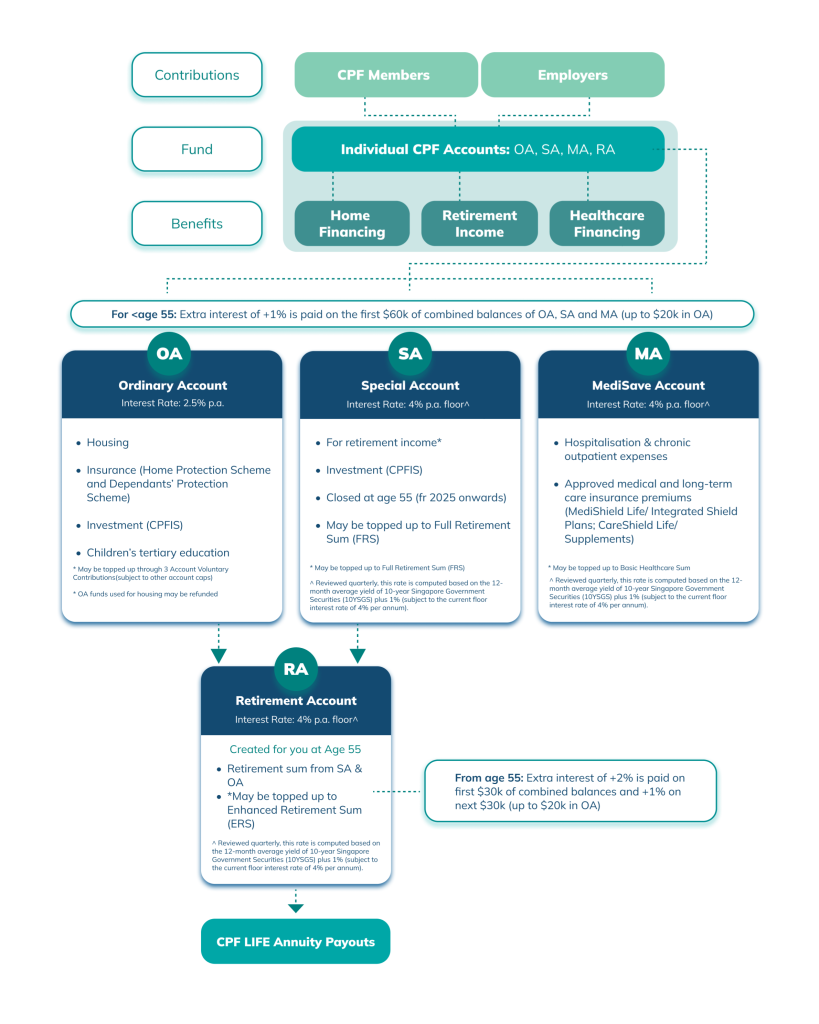

Build on the Bedrock of CPF

Planning for retirement – a time when employment income stops – has become more important as lifespans extend and jobs become more fluid. The 3 Must-Haves: housing, healthcare and money for day-to-day living expenses, are subject to the retiree’s 5 risks of longevity, healthcare costs, inflation, investment risk and overspending.

In Singapore, CPF LIFE serves as the cornerstone of retirement income planning. To meet essential needs, MoneyOwl suggests striving for the Full Retirement Sum (FRS) as a Safe Retirement Income Floor, and topping up CPF early. For additional income, we can consider the dimensions of the “CPFA” framework—balancing Certainty, Probability, Flexibility, and Affordability—using CPF for core expenses and flexible, low-cost investments for discretionary spending.

CPF as the Bedrock for Retirement

1. The 3 Must-Haves and 5 Risks

Retirement planning is essential to ensure a secure and comfortable life after employment income ceases. It begins with understanding the 3 Must-Haves—housing, healthcare, and day-to-day living needs—that form the foundation of financial security.

However, retirees face unique challenges in the form of 5 key risks: longevity, healthcare, inflation, investment, and overspending. These risks, while relevant to all, become more pronounced in retirement due to aging and the absence of regular income.

The 3 Must-Haves throughout life for which we need money are:

- 🏠 Housing

- 🏥 Healthcare

- 🍴Day-to-day living needs (food, transport and lifestyle activities)

For retirees, there are 5 risks that can cause us to run out of money to meet these 3 areas of need:

- Longevity Risk

Longer life expectancy increases the chance of outliving savings. - Healthcare Risk

Aging often brings higher healthcare costs. For chronic diseases to long-term care, MediShield Life and CareShield Life offer basic coverage. - Inflation Risk

As things cost more over time, inflation erodes the purchasing power of retirees’ savings and any fixed annuity income they are receiving. With greater longevity, the impact of inflation will be compounded. - Investment Risk

For many retirees, income from just CPF LIFE may not be sufficient, and their cash savings to supplement CPF LIFE may need to be invested for growth, to last over a longer life span. - Overspending Risk

Overspending can be in the form of (a) big ticket spending funded by lump sum withdrawals, (e.g., from CPF at age 55) or (b) day-to-day spending beyond a sustainable lifelong retirement income.

2. CPF Life as a Bedrock for Retirement

CPF LIFE is CPF’s most important facility and is the bedrock of retirement security for Singaporeans. Learning about CPF LIFE requires an understanding of:

- How the CPF Retirement Account (RA) works

- The differences in the 3 Retirement Sums (BRS, FRS, ERS)

- The difference in payouts between the 3 CPF LIFE Plans (Standard, Basic and Escalating plans)

MoneyOwl’s philosophy on CPF

Our philosophy is to use CPF as the bedrock of retirement planning for Singaporeans. While CPF helps us with all the three Must-Haves, we should look to CPF mainly for risk-free accumulation at good interest rates, towards obtaining a very good lifelong income through CPF LIFE for our living expenses.

A lifelong annuity is the best hedge for longevity risk, and CPF LIFE is widely acknowledged as the best annuity available in the market. While there are always policy risks with government schemes, we do not see them as larger than those of commercial product providers.

Key Takeaways:

- Aim for at least Full Retirement Sum (FRS) as the baseline.

- Start accumulating towards FRS as soon as possible so that CPF interests and your employment contributions can further grow and compound your Retirement nest egg over time.

3. Drawing down Investment Portfolios for Retirement Income

When it comes to drawing down retirement income, these are the two common strategies in the market:

4% Withdrawal Rule:

Draw 4% annually from a balanced portfolio (60% equities, 40% bonds) as a general guide, with flexibility to adjust withdrawals based on market performance to avoid prematurely depleting assets.- Target Date Funds:

Fund managers utilise this approach to shift your portfolio from higher risk (equities) to a lower risk (bonds) as you reach retirement age. However, they often have high expense ratios and may yield insufficient returns, especially in low-interest environments.

MoneyOwl’s recommended approach:

- Use high-certainty instruments for essential expenses:

Secure your essential expenses, such as housing, healthcare, and daily living costs, with reliable options like CPF Special Account (SA) and Retirement Account (RA).

- Use low-cost, globally diversified investments for non-essential expenses:

For non-essential, lifestyle-related expenses, consider investing in globally diversified, low-cost portfolios of stocks and bonds.

- Adjust withdrawals flexibly under the 4% rule:

Follow the 4% withdrawal rule to draw retirement income sustainably while adjusting withdrawals during market downturns, can help preserve your assets from being prematurely depleted.

- Diversify bonds and dividend stocks via professionally managed portfolios:

Minimize concentration and default risks associated with bonds and dividend stocks by investing in low-cost, professionally managed portfolios.

- Transition from high-risk portfolios before withdrawals:

Gradually adjust your investment strategy about five years before you begin retirement withdrawals. Move from higher-risk portfolios to more balanced or conservative ones.

It is never too early to plan for retirement. Balancing our commitment to housing versus investing and getting the right insurance are important decisions that can have a long lasting impact.

Download Ebook

The snippets above offer a snapshot of our approach to comprehensive retirement planning. Download our eBook for an in-depth look at the core retirement needs, strategies for securing lifelong financial stability using CPF, and insights into mitigating common retirement risks. Simply complete the form to join our Mailing list, and we’ll send you an email with the eBook.