Should we buy private Integrated Shield Plans, since Singapore’s subsidised healthcare is world-class?

Our CEO and Chief Investment Officer, Chuin Ting Weber, shares her perspectives on Integrated Shield Plans.

“Zhng”your MediShield Life with a low-cost Integrated Shield Plan

“Zhng”: Verb. Singlish for “upgrade”

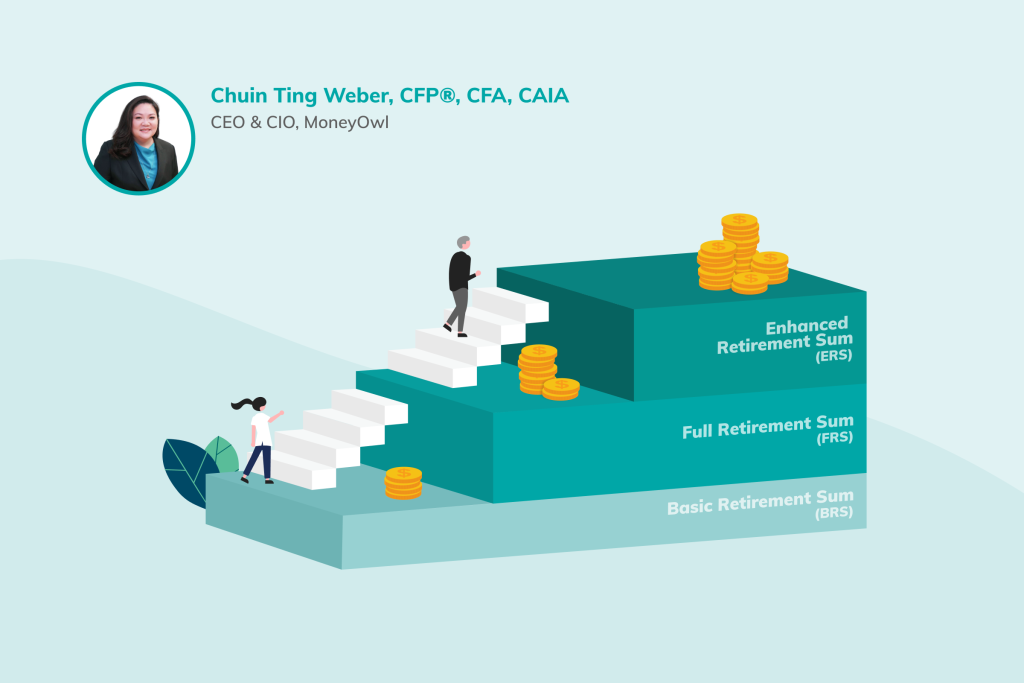

Can encouraging more CPF savings crack the retirement code?

Article by The Straits Times,

20 February 2024

Final Investment Note of 2023: The Best of Times and The Worst of Times

MoneyOwl’s CEO and Chief Investment Officer encourages investors to look beyond the down moments to the logic and evidence of the markets, and to embrace a sufficiency mindset.

Why iFAST? Hear from MoneyOwl’s CEO

MoneyOwl’s CEO shares the 5 key considerations in the deep evaluation we went through in selecting iFAST to take care of our clients post wind-down.

Shaping Your Financial Future: How Comprehensive Financial Planning Can Make Your Dreams a Reality

Financial freedom is a tenuous process and requires years of preparation, hard work, and grit. However, it need not be difficult or complex, simply requiring consistency and discipline alongside the support of an empathetic and effective coach and guide.

Should I ‘Divorce’ My Investment-Linked Policy?

In recent years, Investment Linked Policies (ILPs) have attracted much interest (and debate), from their flexibility and potential for higher returns to the criticisms of high fees and disappointing investment returns. Discover how to check if your ILP still fits your personal needs and financial goals in three steps!

5 Smart Ways to Clear Your Debts Fast

Financial missteps and hasty choices can lead to a lifelong struggle with debt. Here are five common pitfalls of credit and strategies to sidestep them.

Tips for Parents with Young Children to Tackle the Rising Cost of Living

Raising children is a rewarding experience, but it comes with its fair share of financial challenges, especially in today’s world of ever-increasing living costs. From creating a budget and prioritising needs over wants to exploring cost-saving measures and seeking alternative sources of income, these practical tips can empower parents to navigate financial challenges and provide a stable environment for their family.

Creating a Robust Emergency Fund: Financial Resilience Amid Rising Living Expenses

With living expenses on the rise, it is crucial to establish a strong emergency fund to ensure financial resilience. Learn how to navigate the challenges and safeguard your financial future.