By: Daphne Lye, CFP

Senior Lead, Solutions, Research & Investment, MoneyOwl

The Ministry of Health (MOH) just announced the latest changes to new riders sold from April 2026:

- No longer permitted to cover deductibles

- Co-payment cap to raise to minimum of $6,000 per year (up from minimum of $3,000)

The premiums of these new riders are expected to be more affordable – Premiums of the new private hospital riders will be 30% lower on average, compared to existing riders with maximum coverage.

But first, what are riders and how do they work in the context of Singapore’s healthcare financing system?

For most of us, our hospitalisation insurance is in the form of:

- MediShield Life which is the basic national healthcare insurance, and

- Integrated Shield Plans, which are optional plans offered by insurers that sit on top of MediShield Life. A rider may be purchased on top of an Integrated Shield Plan.

What do riders do?

The main use case of riders is to reduce out-of-pocket costs when you are hospitalised. Under MediShield Life and Integrated Shield plans, there are two parts of a hospital bill that has to be paid by the patient and are not covered by insurance:

- Deductible – This is the first portion of your hospital bill you need to pay before your insurance kicks in. It is similar to an “excess” in car insurance. It screens out small claims so that insurance can pay for your large hospital and treatment bills.

The deductible is payable once each policy year, and ranges between $1,500 and $4,500 depending on age, ward type and hospitalisation plan. - Co-insurance – After paying the deductible, you will also need to pay a percentage of the remaining bill.

These cost-sharing mechanisms help lower overall premiums for everyone. By splitting the bill with the insurer, policyholders will be more mindful of their medical expenses and treatment choices so that the system will be more sustainable.

Riders reduce these out-of-pocket costs for policyholders. If you have a rider, your out-of-pocket costs can be reduced to 5% of the total bill. Currently, this can be further capped at $3,000 per year if you seek treatment from the insurers’ panel of doctors.

Below is an example of how a rider works to reduce the out-of-pocket costs, assuming a $20,000 hospitalisation bill with a $3,500 deductible and 10% co-insurance:

| No rider | Current rider that covers deductibles and limits co-payment to 5% up to $3,000 | |

| Pay the deductible | $3,500 | — |

| Pay the co-insurance | $1,650 [10% of ($20,000 – $3,500)] | $1,000 [5% of $20,000] |

| Total out-of-pocket | $5,150 | $1,000 |

| Insurance pays out | $14,850 | $19,000 |

In addition to reducing the out-of-pocket payments, depending on your insurer and rider plan, policyholders can also enjoy additional benefits from riders such as:

- Enhanced cancer coverage that covers drugs outside the Cancer Drug List, or higher claim limits on cancer treatments

- Daily hospital cash benefits to cover accommodation charges for family members

- Extra benefits on discharge such as post-hospitalisation home care or even coverage for rehabilitation and mobility aids.

Trade-offs of riders

However, rider premiums must be paid in cash and are costly at older ages.

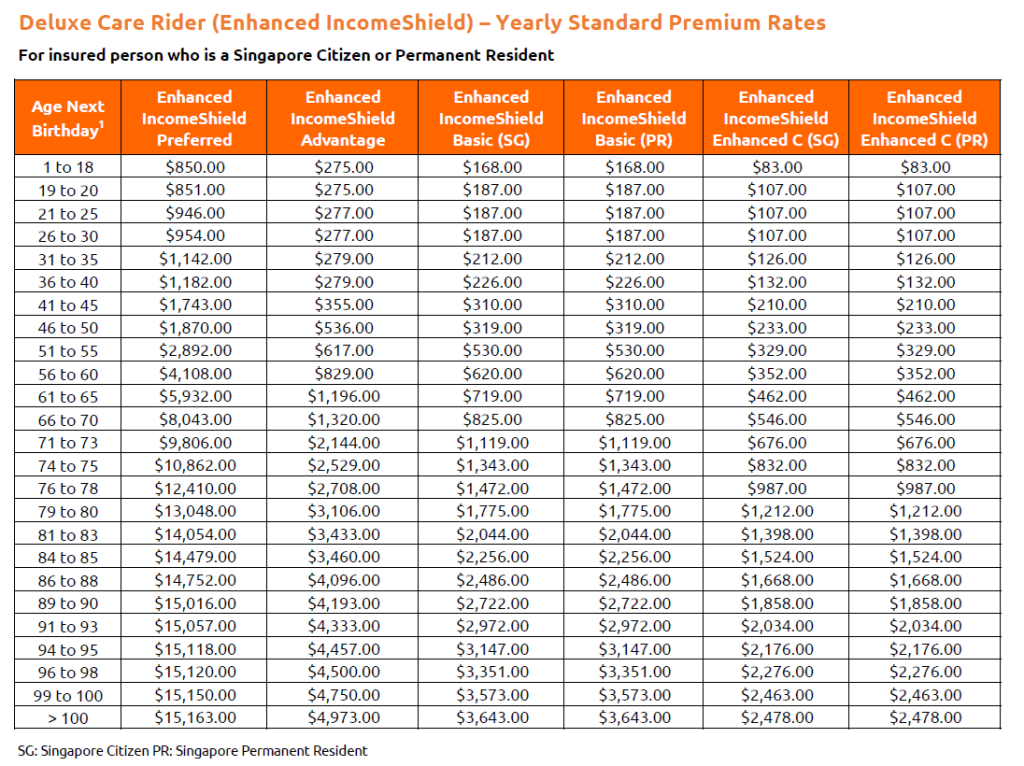

Below is an example of an insurer’s rider premiums and how it rises with age:

You may also consider that the out-of-pocket amounts can be paid with your MediSave savings up to specified limits, and are generally manageable if you opt for lower ward classes.

What do the changes mean for you?

Like all insurance plans, there is balance between cost and coverage. A more comprehensive plan will be more expensive with higher premiums, while an insurance plan with a higher co-payment from the policyholder will be more affordable.

Even with the new higher co-payment, riders can still provide some peace of mind by capping the out-of-pocket amount.

In the same example of how the new rider works for a $20,000 hospitalisation bill with a $3,500 deductible and 10% co-insurance:

| No rider | Current rider that covers deductibles and limits co-payment to 5% up to $3,000 | New rider that does not cover deductibles and limits co-payment to 5% up to $6,000 | |

| Pay the deductible | $3,500 | — | $3,500 |

| Pay the co-insurance | $1,650 [10% of ($20,000 – $3,500)] | $1,000 [5% of $20,000] | $825 [5% of ($20,000 – $3,500)] |

| Total out-of-pocket | $5,150 | $1,000 | $4,325 |

| Insurance pays out | $14,850 | $19,000 | $15,675 |

If you’d like to understand how the amount you pay may change under the new rider structure, you can compare costs using our calculator here: Nov 2025 IP Rider Change Calculator.xlsx

One advantage of the change is that premiums for riders will come down overall. This makes it mre affordable and sustainable to continue holding on to riders in your older ages, which is when you are most likely to require hospitalisation.

On average, the premiums of new private hospital riders expected to be about 30% lower on average, compared to existing riders with maximum coverage.

This translates to annual premiums savings of around $600 for private hospital IP rider policyholders, and around $200 for public hospital rider policyholders.

Furthermore, older policyholders will see greater premium savings on average.

If you currently hold an IP rider:

You will continue to enjoy the terms of your existing rider. Your insurer will study and determine their own approach for their existing rider policyholders.

You can buy the new IP rider from April 2026. You can speak to your financial advisor and consider if the new IP riders better suit your needs.

If you currently do not have an IP rider:

You can still purchase existing riders until 31 March 2026, but you will have to transition to the new riders no later than your next policy renewal after 1 April 2028.

MoneyOwl’s Advice

If you are deciding whether to buy a rider or downgrade it, consider the following factors:

- Insurability: It is much easier to get comprehensive coverage when one is younger and in good health, and conversely more difficult when one is older due to the increased risk of developing health conditions.

Hence, you can consider getting higher coverage that meets your needs when you are younger, and downgrade later when it becomes less affordable. - Healthcare Preference: The key consideration in health insurance is the IP type, or level of ward class covered by the IP. Hence it is critical to ensure that you are on an IP plan that suits your needs.

The premiums of riders generally follow that of the IP plan.

For example, a rider for a private hospital IP will be much higher than a rider for a public hospital A ward IP.

If you are looking to manage your healthcare insurance cost, you can consider dropping to a lower tier ward which you are comfortable with, instead of doing away with the rider.

Finally, riders come in to offer greater peace of mind when you opt for higher class wards or private hospitals due to the larger hospital bill.

If you are comfortable with a lower class ward, MediShield Life and the basic IP may be sufficient for your needs as the out-of-pocket amount will be lower due to the smaller bill size. - Cost versus Coverage: Weigh the additional premiums against the potential out-of-pocket expenses they cover.

For healthy individuals who may be hospitalised infrequently, simply paying the deductible and co-insurance when necessary might be preferred compared to paying years of rider premiums.

This is especially if they are able to invest the premium savings to offset future healthcare costs.The premiums of riders generally follow that of the IP plan. - Additional benefits: Some riders offer enhanced benefits such as enhanced cancer coverage and pre- and post-hospitalisation expenses.

Assess if these extra benefits are worth the additional cost based on your family medical history and lifestyle.

A final point to note is to not switch IP insurers simply based on premiums or specific benefits.

This is because switching insurer requires new underwriting which could lead to exclusions for any pre-existing illnesses that developed and were covered under your old policy. This can result in these conditions being excluded from coverage or having to pay higher premiums.

New policies also often have waiting periods when you cannot make a claim.

Furthermore, IP premiums are non-guaranteed, and switching to a lower cost plan does not guarantee that the premiums will remain the low in future years.

If you wish to adjust your insurance coverage at policy renewal to meet your needs and budget, you should do so within the same insurer to maintain continuous coverage for any conditions developed while insured.