By Daphne Lye, CFP®

Senior Lead, Solutions, Research & Investment, MoneyOwl

Introduction

The Household Balance Sheet, published by the Department of Statistics (DOS) every quarter, shows the assets and liabilities held by households at the end of each period.

Assets are what households own or their wealth. This includes cash in the bank, CPF balances, investments, and property.

On the other hand, liabilities are what households owe or their debt, which includes housing loans, car loans and credit card bills.

The difference between assets and liabilities shows net worth of households, which is one indicator of financial health. A positive net worth means assets are more than liabilities – you own more than what you owe, while a negative net worth means the opposite.

Let’s look at some key trends in Singapore’s household balance sheet and what they mean for your personal financial planning.

Overview of the National Household Balance Sheet

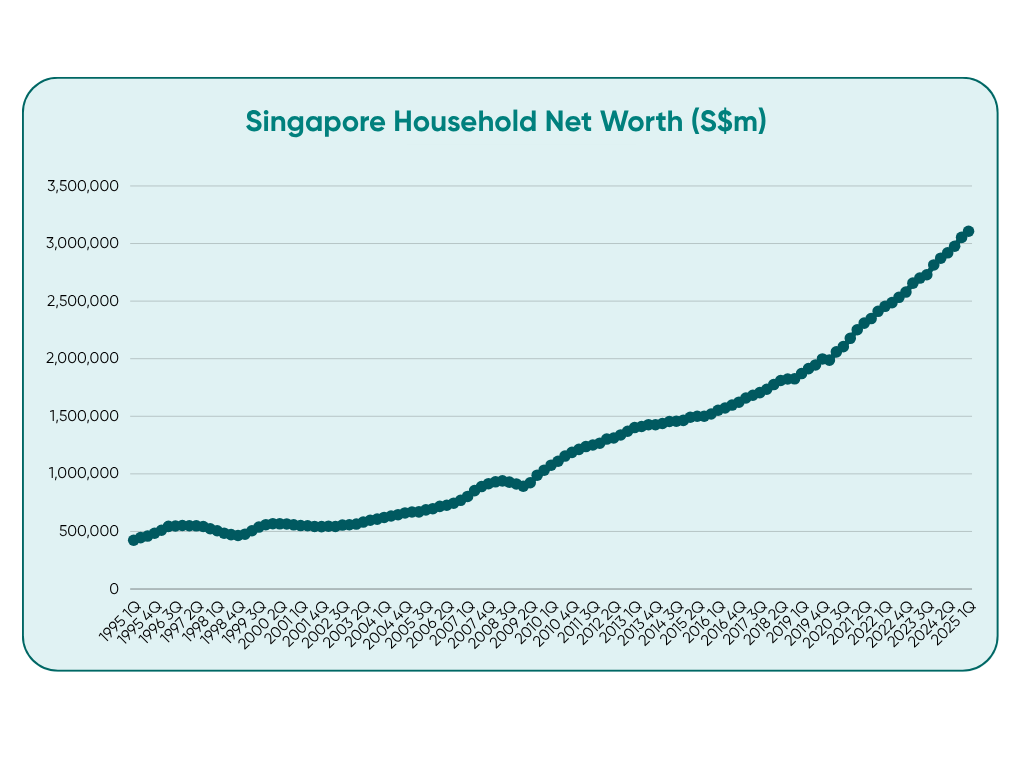

Singapore households’ net worth has been positive since the first data set in Q1 1995, with net worth continuing to increase, reaching S$3.1 trillion in Q1 2025.

The growth of households’ net worth has been rising faster in recent years. The annualised change1 over the past 10 years is 7.6% p.a., while the annualised change over the past 5 years is higher at 9.4% p.a.

Looking at Household Assets

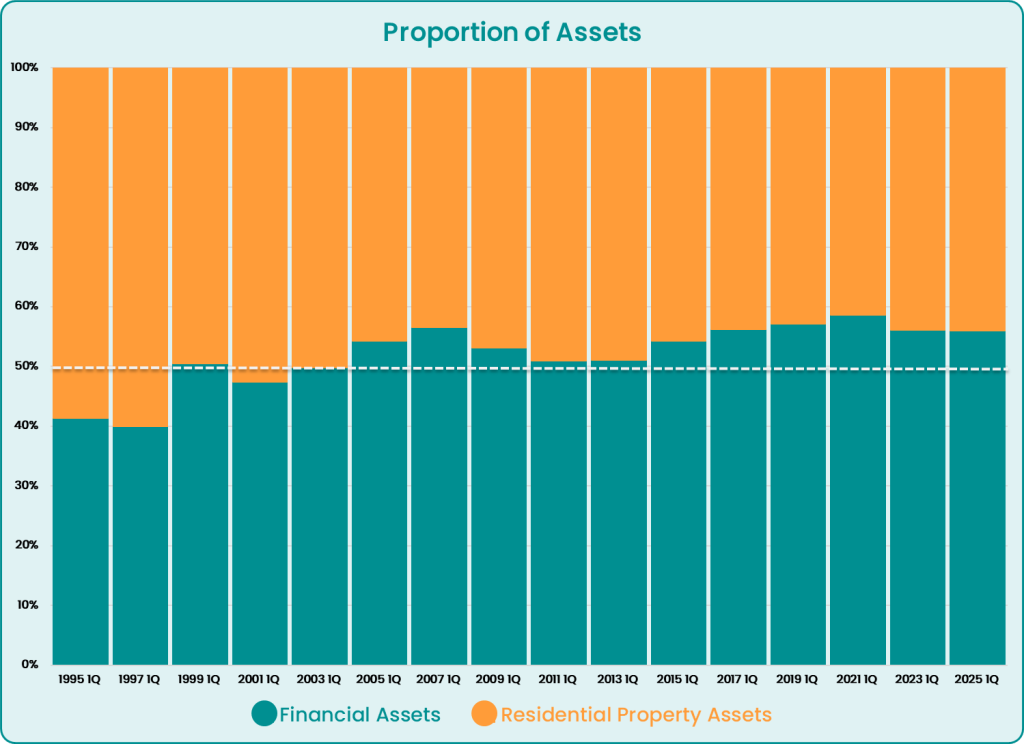

In the Household Balance Sheet, assets are split between Financial Assets and Residential Property Assets.

As of Q1 2025, Financial Assets made up 56.0% of assets, while Residential Property Assets made up 44.0%. Financial Assets made up a slightly larger proportion of Assets in most years.

For comparison, a much larger proportion of assets owned by American households are in financial assets. As of Q1 2025, 68% of American households’ assets are in financial assets, and only 25% in real estate2. This difference is likely a reflection of Singapore’s high level of home ownership, though it could also indicate that Singaporeans are not as comfortable in financial investments.

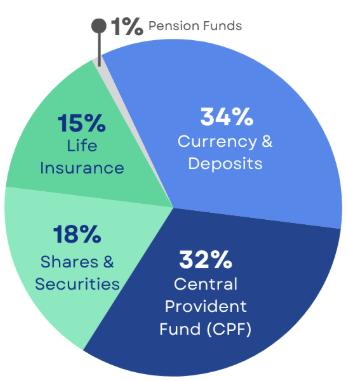

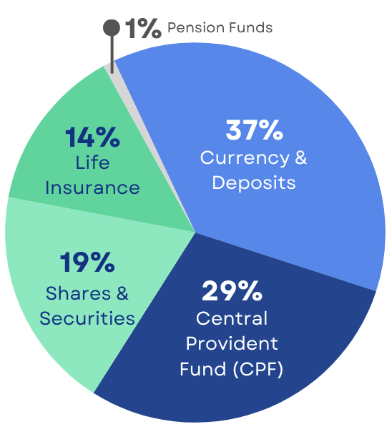

That we are relatively conservative with risk is also borne out in the fact that within Financial Assets, Currency & Deposits make up the largest proportion at 34%.

A snapshot view from data 10 years ago (below) would show that CPF savings grew its share of the Financial Assets pie the most, up from 29% as at Q1 2015, to 32% as at Q1 2025.

Looking at Household Liabilities

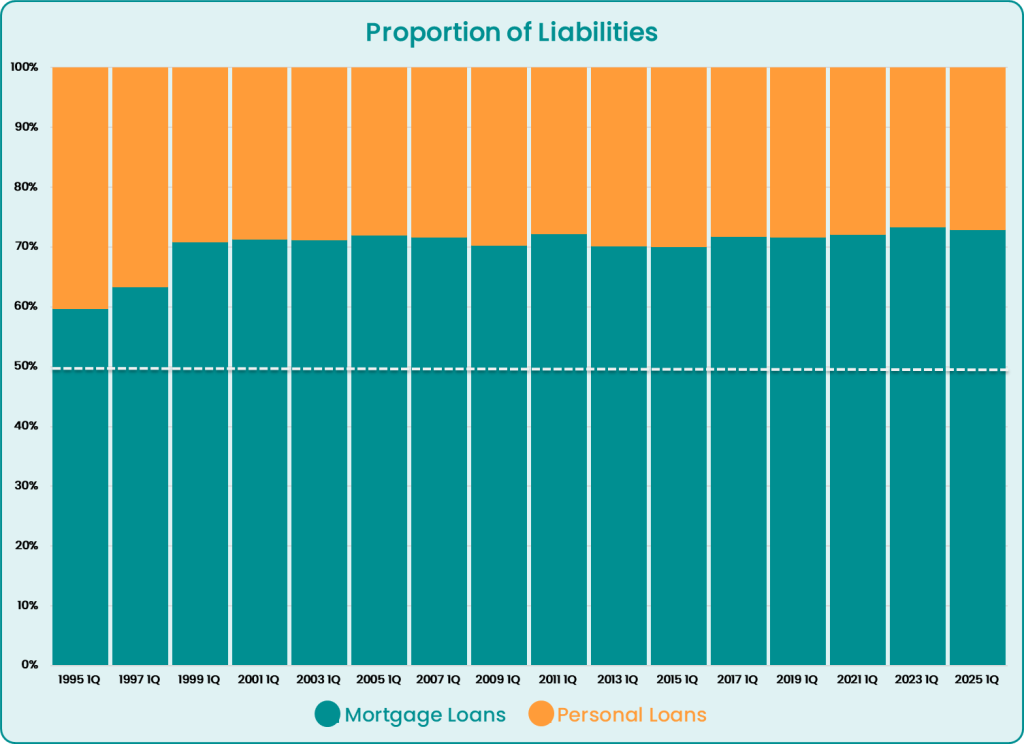

Singapore Household Liabilities are split by Mortgage Loans and Personal Loans.

The proportion of Mortgage Loans in Q1 2025 is 72.9%, while Personal Loans stand at 27.1%. This proportion has remained steady in recent years.

In the Personal Loans category, the growth of Credit/ Charge Cards experienced the highest growth rate of 8.1% p.a. over the last 5 years, or 4.7% p.a. over the last 10 years.

| Annualised Change over 5 years | Annualised Change over 10 years | |

| Motor Vehicle | 0.1% | 1.2% |

| Credit / Charge Cards | 8.1% | 4.7% |

| Others | 2.8% | 0.8% |

Thoughts on Personal Financial Planning

The national household balance sheet is an aggregate of what all the households in Singapore own and owe.

It may be useful to look at the categories and consider how we are doing as individuals in terms of our net worth – perhaps even construct our own balance sheet.

1) Importance of liquid savings or emergency funds

The personal parallel to “Currency & Deposits”, for example, would be our cash at hand.

For individuals, besides net worth, a key indicator of financial health is your liquidity ratio, or whether you have enough cash savings to cover 6 to 9 months of expenses (MoneyOwl’s recommendation). This fund helps you to tide through a sudden job loss or family emergency without resorting to debt, selling your investments at a bad time or disrupting your long-term financial goals.

The sustained growth in “Currency & Deposits” shows that Singapore households are continuing to build up their cash savings.

Such a fund should be kept liquid, so that you can access it at short notice and without any loss in value. This includes high yield savings accounts, fixed deposits, or in Singapore Savings Bonds.

2) Importance of investing

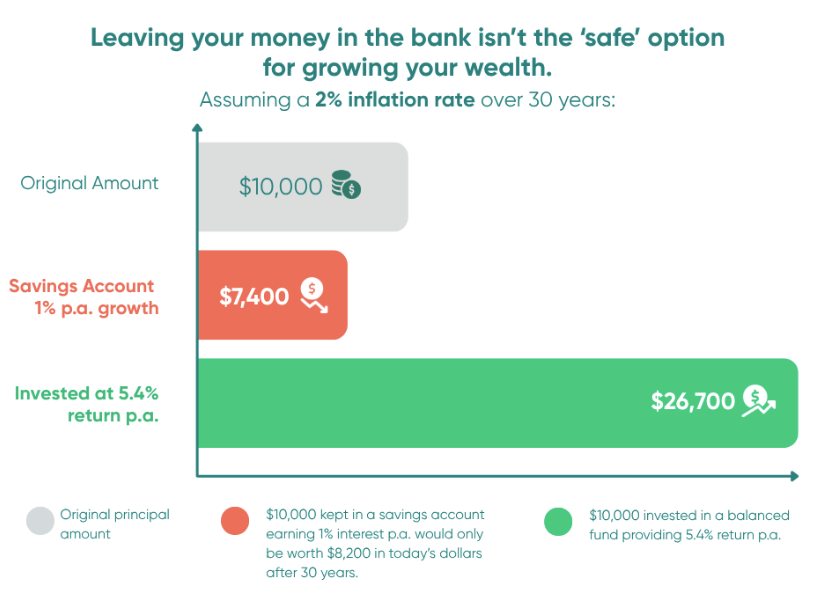

While an emergency fund gives you a strong foundation, holding too much cash is not desirable either, as the value of your savings will not able to outpace inflation.

While cash savings provide short-term security, investing helps your money grow over time and keeps you ahead of inflation to preserve the value of your long-term savings.

Investing is how you can attain life goals such as retirement and your children’s tertiary education.

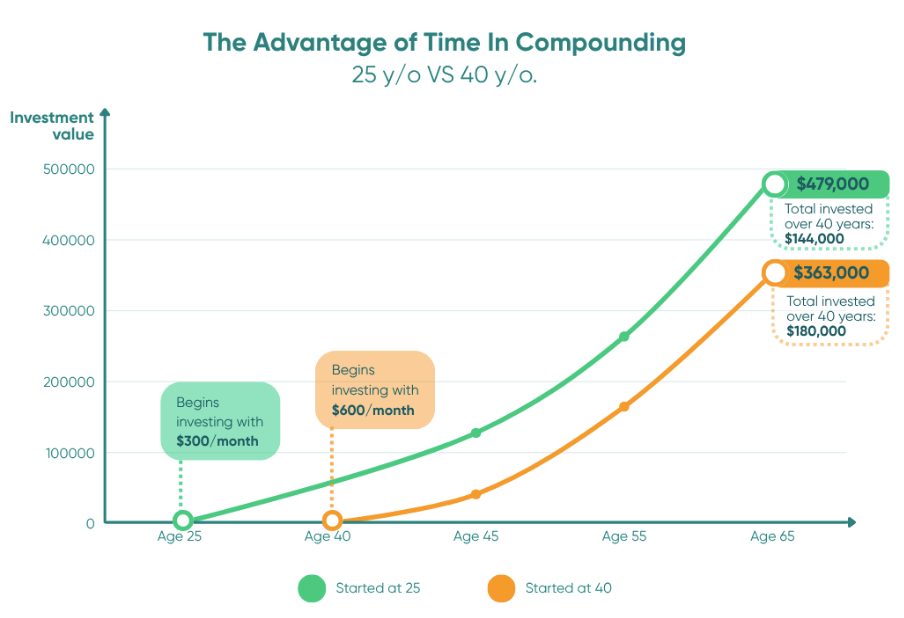

Take advantage of time to leverage the power of compounding. A 25-year-old who invests $300 a month will have more at retirement than a 40-year-old who invests $600 a month. Even though the latter puts in a larger overall amount.

3) Balancing between Property and Financial Assets

Singapore households hold over 40% of their assets in Residential Property, with many believing it is a safe and appreciating asset.

While this has held true in Singapore historically, over-concentration in housing can limit liquidity and flexibility. Unlike stocks or unit trusts where you can partially sell off your holdings to actualise the gains, a property is an indivisible asset ‐ you cannot just sell 10% of your home if you need $50,000. It is also illiquid and takes time and costs to sell.

Rising property values is a paper gain, and not spendable wealth. As you live in your house, selling it to realise a gain means you will need to buy or rent another home, which may also have risen in price.

Appreciation in your property is only meaningful if you plan to unlock and use that value. While there is a desire to leave a legacy to one’s children, the priority should be your own needs, including retirement income. Monetising your home would involve selling and downgrading, renting it out, or tapping on schemes such as the Lease BuyBack Scheme.

Make sure you are not stuck with ‘wealth on paper’ while struggling with cash flow or falling short on retirement.

4) CPF remains a key plank in our personal finance

With regular, steady contributions and high risk-free rates of up to 5% p.a., CPF balances continue to grow. We have done simulations on how a young working adult today can accumulate over $1 million in CPF balances by retirement.

But with over 60% of our early CPF monthly contributions going to the Ordinary Account which can be used for housing, it means that less is set aside as liquid retirement funds.

To ensure that we continue to save up sufficiently for our retirement, we recommend for all to aim to achieve at least the CPF Full Retirement Sum in their CPF Special Account, which is $213,000 in 2025.

5) Watch out for growing personal debts which are consumption driven

Rising personal loans are a financial red flag. This may reflect that people are borrowing more to cover everyday or lifestyle expenses, rather than for essential needs or income-generating assets such as a property.

Such loans typically charge very high interest rates, and when you are unable to keep up with repayments, it could lead to a debt spiral where you borrow more just to keep up with loan repayments.

Faster and more convenient loan approvals may also outpace borrowers’ discipline or understand of repayment obligations. For example, Buy Now Pay Later (BNPL) schemes may mask true debt levels as you inadvertently spend more than what you planned to.

Such non-productive debt can damage long-term financial health if not managed properly. At MoneyOwl, we recommend keeping non-mortgage debt servicing ratio to under 15% of your take-home income.

If you have outstanding high-interest personal loans, prioritise paying them off as soon as possible before investing or spending on non-essentials.

Conclusion

While the national balance sheet offers a snapshot of the economy, your personal balance sheet is where true financial control begins. Take time to review your own — list your assets and liabilities, track your net worth, and set meaningful milestones. Building your balance sheet through regular budgeting and intentional saving and investing helps you measure progress, not just activity.

When your finances are in order, you reduce anxiety and gain the confidence to make better decisions. Progress starts with clarity — and your net worth is one of the clearest indicators of where you stand and where you’re headed.

Footnote

- Annualised based on YoY rate of change from 2021-2025 for 5 years, and 2015 to 2025 for 10 years. ↩︎

- Source: The Federal Reserve. Remaining assets are in non-profits and consumer durables. ↩︎