Did you know you can enjoy tax relief when you contribute to your Supplementary Retirement Scheme (SRS)? Find out how you can get started and learn all about SRS with this handy guide.

It is the time of the year when the focus is on the Supplementary Retirement Scheme (SRS) again as the deadline for contributing to the SRS draws closer.

Despite the benefits that come with the Supplementary Retirement Scheme (SRS), it is often overlooked as some find it difficult to understand how the scheme works.

In a snapshot, the SRS is a voluntary scheme to encourage us to save for retirement, over and above our CPF savings. Each dollar of SRS contribution will reduce our income chargeable to tax by a dollar in the next Year of Assessment (YA). Besides, only 50% of the withdrawals from SRS are taxable after retirement age and investment gains in SRS accumulate tax-free before the withdrawal.

How Can We Benefit From SRS?

We illustrate using an example:

1. Enjoy Tax Savings

Assuming you have a taxable income of $72,000 before tax-relief from SRS,

*Tax payable on $72,000 = $550 (on the first $40,000) + $2240 (7% on the remaining $32,000)

= $2,790

If you contribute $15,300 to SRS by 31st December 2024, you can enjoy $15,300 of tax relief in the Year of Assessment (YA) 2024 (for the year ended 31 December 2023).

Your taxable income would be= $72,000 – $15,300 = $56,700

*Tax payable on $56,700 =$550 (on first $40,000)+ $1169 (7% on the remaining $16,700)

= $1,719

Tax savings = $2,790 – $1,719 = $1,071

As announced in Budget 2024, a Personal Tax rebate will be granted to all tax residents for Year of Assessment 2024. The rebate will be 50% of tax payable, capped at $200.

Tax payable after Personal Tax rebate = $1,719 – $200

= $1,519

*Based on IRAS’ current income tax rates and brackets.

**Please note that from the Year of Assessment 2024 (when income earned in 2023 is assessed to tax), there is a personal income tax relief cap of $80,000.

At retirement, you can withdraw your SRS savings over 10 years. For example, if you have $400,000 saved at age 62, withdrawing $40,000 yearly means only $20,000 (50% of $40,000) is taxable. With no other income, the first $20,000 is tax-free under current tax rates, so you won’t pay any taxes.

Important Pointers About SRS

There are some key areas about contributing and withdrawing from your SRS account that would be useful for you to know if you are considering making use of it.

1. SRS Contributions

The current cap of contribution to SRS each year for Singaporeans and PRs is $15,300 and $35,700 for foreigners. All SRS contributions must be made in cash and contributions can be made any time and any number of times in a year before 31 December each year to enjoy tax reliefs in the Year of Assessment (YA) the next year.

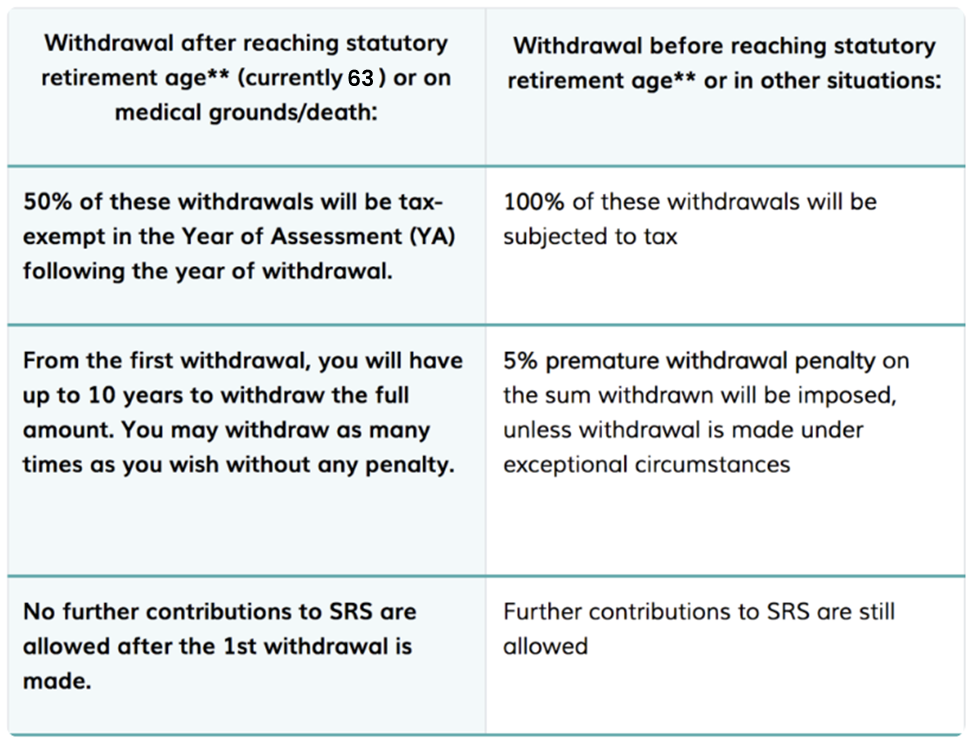

2. SRS Withdrawals

**Retirement age is defined as statutory retirement age that was prevailing when you made your first SRS contribution (currently age 63, and will be raised to age 64 in 2026. The raise will be applicable to those born on or after 1 July 1963).

SRS withdrawals could be made in the form of investments, i.e. you do not have to liquidate your investments when you withdraw them from your SRS account. There is also a tax exemption of up to $400,000 for SRS funds deemed withdrawn upon demise, or withdrawn in full on the grounds of a terminal illness. This is to ensure that SRS members are not unduly disadvantaged due to terminal illness or death.

How Can I Get Started?

If you are keen to enjoy tax savings using SRS contributions, here are the steps to get started:

- Step 1: Open an SRS account with DBS, OCBC or UOB and contribute cash to your SRS account.

- Step 2: You can invest your SRS funds into shares, bonds, unit trusts, fixed deposits and single premium insurance products from financial institutions to gain a better return on your monies contributed to your SRS account. Monies left in SRS account of the three local banks earn an interest of only 0.05% p.a.

- Step 3: IRAS will grant the tax relief to you automatically in the year following the year of contribution provided and will be reflected in your Notice of Assessment, based on information provided by the SRS operators.

I hope this article has been useful for you to understand the features and benefits of SRS.

As we draw nearer to the end of the year, don’t forget to contribute to your SRS by 31st December 2024!

This article was first published in December 2018 and was updated in December 2024.