Build your financial literacy with tips and guides from MoneyOwl’s team of expert advisers.

General

General

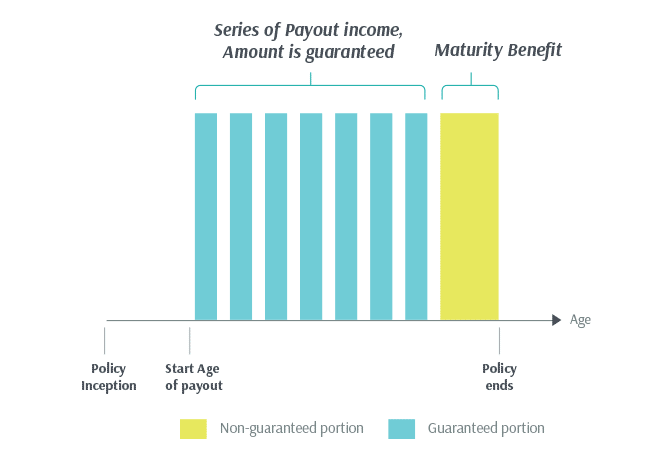

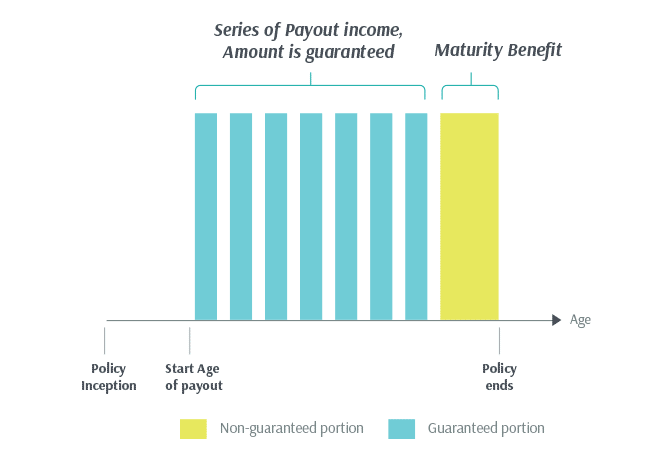

Retirement Income Plans

General

General

General

Retirement Income Plans

Get the best of MoneyOwl delivered straight to your inbox.