Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Find out more on the eligibility and benefits of Medishield Life that help address the basic healthcare needs of Singapore

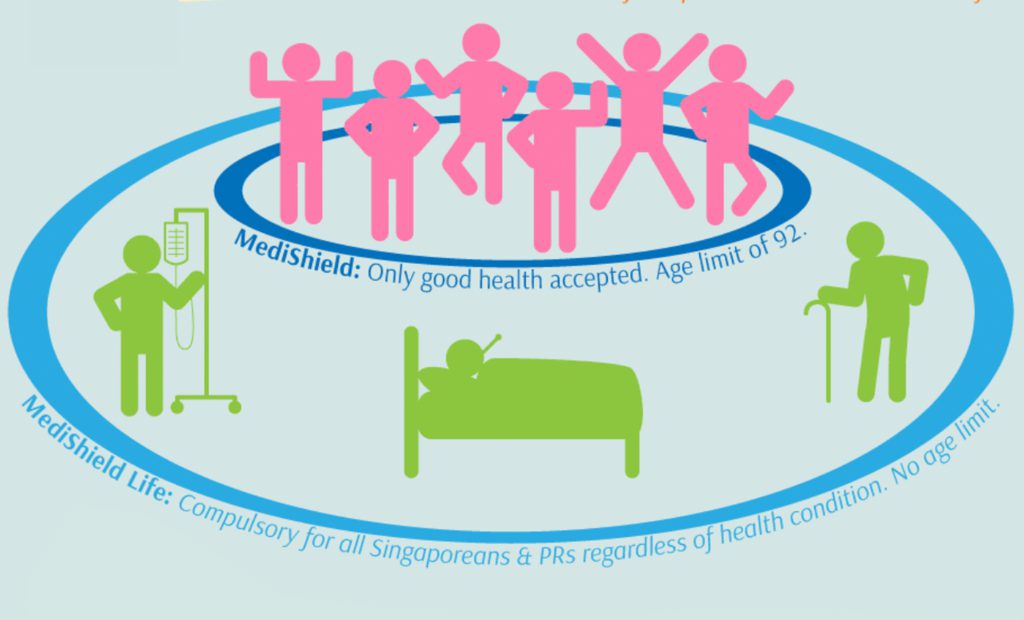

MediShield Life is a significant upgrade of the current MediShield to help address the basic healthcare needs of Singapore.

Beginning at the end of 2015, all Singapore citizens and permanent residents will be included in the new compulsory scheme, regardless of age and health. In addition, all pre-existing conditions will be covered.

Compare Eligibility

MediShield Life offers better protection by increasing its claimable benefits and lowering the co-insurance (the portion you need to bear). Besides higher inpatient benefits, outpatient benefits such as chemotherapy for cancer will also be increased. Essentially, a larger portion of the hospital bill is now claimable, resulting in smaller out-of-pocket expenses.

Compare Key Benefits

1 The amount the insured must first pay before the insurance policy starts paying out any claim. If the claimable amount is less than the deductible, no claim will be payable. The deductible applies on a policy year, which means a number of smaller bills can be added up within the policy year to meet the deductible.

2 The portion of the claimable amount that the insured needs to bear after setting aside the deductible.

In summary, MediShield Life:

- Offers higher benefits

- Covers pre-existing conditions

- Is for all people and for life

- Is compulsory, no opt-out

- Is suited for B2/C class wards

- Starts in 2015