Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Dear Client,

From CEO/CIO’s Desk: Spoiler Alert!

This year, there have been quite a number of grand finale episodes to blockbuster movies and TV series, as well as a few major football matches. Nothing beats the experience of watching Avengers: Endgame, the last episode of The Game of Thrones or the Liverpool-Spurs Champions League Final live on TV at an unearthly hour. If you were to watch it again, the feeling just wouldn’t be the same because you already know how it went and how it ended. If you are a good person, you would not spoil the fun for your friends by telling them about it beforehand!

Investing during political, economic and market drama is similar, insofar as how heightened and engaged our emotions are in the midst of it. What is different, however, is that these impulses are not the positive anticipation with blockbusters and football, but the negative emotions of anxiety and fear – fear either of losing or fear of losing out – which can cause investors to take actions that hurt their personal long-term financial goals. The other difference is that a good financial adviser will “spoil” the stress created by the drama, by reminding you of both the empirical and theoretical foundations of the investment philosophy behind the portfolios you have invested into.

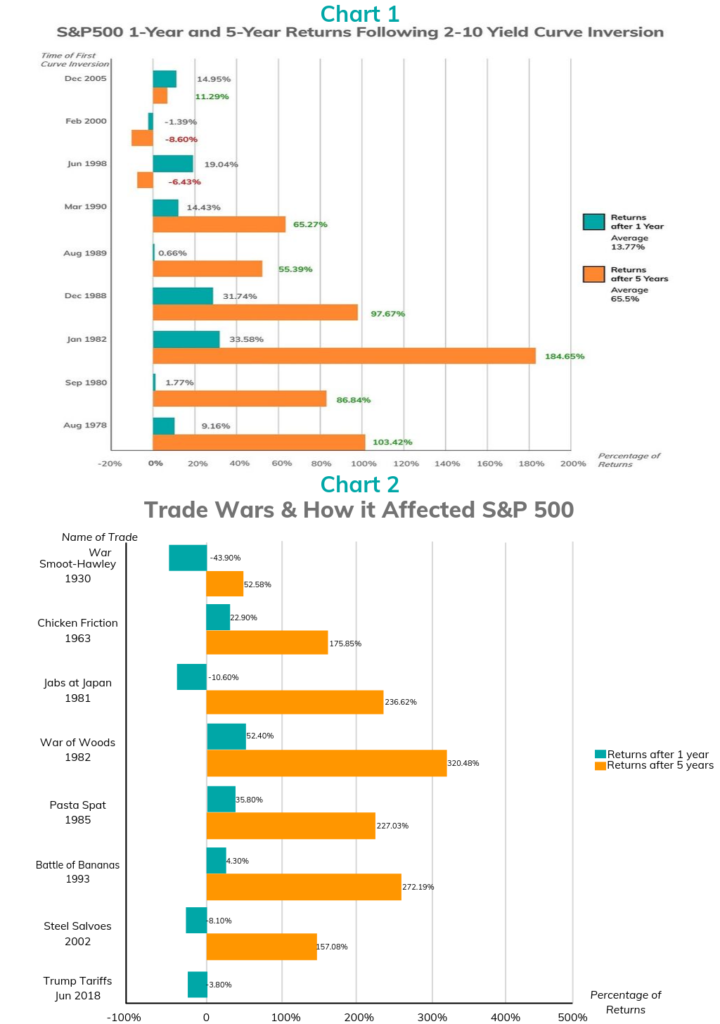

For the month of August, both the S&P500 and the global MSCI All Country World Index were down about 3%. Intra-month, the turbulence was worse and I had written to you in late August about how two major themes had been riling the markets: the bond market and trade wars. On the first, you have already seen our “spoiler” in Chart 1 below, on how a yield curve inversion – whether or not a reliable indicator predicting an economic recession – does not necessarily mean that markets will go down in the subsequent one or five years. On the second topic of trade wars, please see Chart 2 on the S&P500 performance in the 1-year and 5-year periods after some trade wars in modern history.

Once again, while we know, in theory, that trade wars are bad for the economy and for earnings, market performance does not always behave according to the logic of economists and the actual result in the short term of one to five years is hard to predict.

On the political front, the drama and anxiety are no less. British politics have continued their twists and turns with unresolved worries over Brexit, while in Italy, a political and budget crisis might have been averted for now with the once anti-establishment Five-Star party forming a coalition with the Democratic Party. Closer to home, the relationship between Japan and South Korea remains fraught with tension and protests and violent clashes in Hong Kong have entered into the third month. Today being the 18th anniversary of the 911 terrorist attacks, we are also hearing news about President Trump’s suspension of US-Taliban talks and his subsequent firing of John Bolton from the latter’s post as National Security Adviser, casting uncertainty about the road ahead for the Afghan peace process.

While I have no spoiler alert on how any of this would end politically speaking, what we do know is as far as the markets are concerned, they will recover and go up in the long run. In the last 50 years, we have seen major crises such as the oil crisis, two Iraq wars, the Asian financial crisis, the Russian government bond default, 911 terrorist attacks, the Global Financial Crisis arising from US subprime mortgage crisis, European debt crisis, Syrian wars and more recently, Brexit and trade wars – but the market has always recovered.

Yes, this time may be different because each time when stock markets fluctuate in the short term, it is for different reasons. But as long as collectively there is a growing demand for these goods and services, the global stock market as a whole – not individual securities – will go up over the long term. The key driver of this demand is a growing global population that collectively increases its standard of living.

These are the fundamentals that explain why we are confident and why you can also be confident about keeping to your financial plan. Don’t let the drama rob you of the investing success that will be yours if you stay invested in a globally diversified portfolio suited to your risk profile, that is, your need, ability and willingness to take risk. But if there is any concern at all, do give us a call and let us talk through it with you.

Yours Sincerely,

Chuin Ting Weber, CFA, CAIA

CEO & CIO, MoneyOwl