Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

The 4 Best Education Savings Plan for your child starts when you start saving early

Start Planning Early

There is an immense joy that comes with parenthood. While we savour the joy our children bring into our lives, we are also constantly thinking about their futures. In particular, their education is the biggest concern and is a major financial commitment.

Decide How Much to Save

Before deciding which product to buy, you must first establish how much you need to save. We have developed an Education Savings Calculator to help you determine how much you need to save towards your child’s university education. You would need to input the following:

- Number of years before your child enters University

- The intended course of study

- How much to provide

Endowment policies are suitable for parents who do not prefer to take too much risk and yet want better returns than what the banks provide. There are now endowment plans specifically designed for children’s education, which spread the maturity payout over the University years instead of just providing a lump sum at the end of the policy.

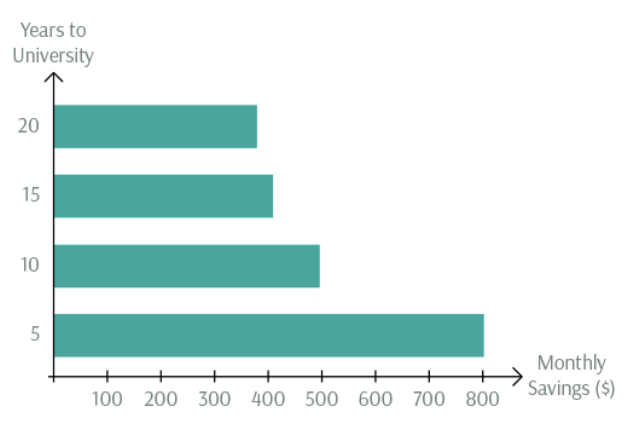

The following diagram gives a sample of how much one would need to save in the endowment plan for a child entering University in the next 5, 10, 15, and 20 years. Clearly, the more time you have to save for your child’s education, the less you need to save every month. It pays to start early.

4 Different Endowment Plans At A Glance

Let’s take a look at the payout structures of 4 endowment plans specially designed for children’s education.

- Gro Junior Saver (NTUC Income)

- Tokio Marine Kidstart

- Aviva MyEduPlan

- Manulife Educate

For this illustration, we have used the following profile:

Age: 1-year-old (next birthday)

Gender: Male

Savings Amount: ≈ $6000 per annum

Premium Duration: 10 years (except for Manulife Scholar (II))

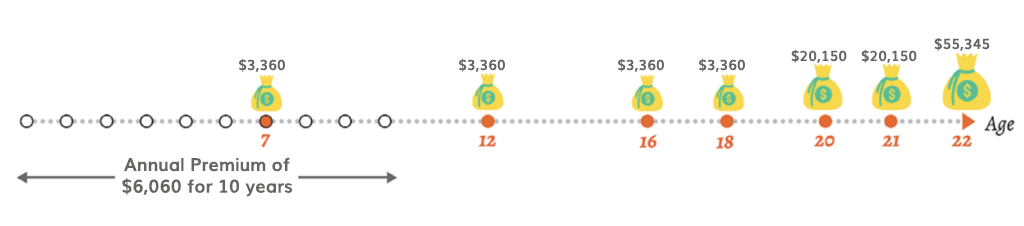

(1) Gro Junior Saver (NTUC Income)

(2) Tokio Marine Kidstart

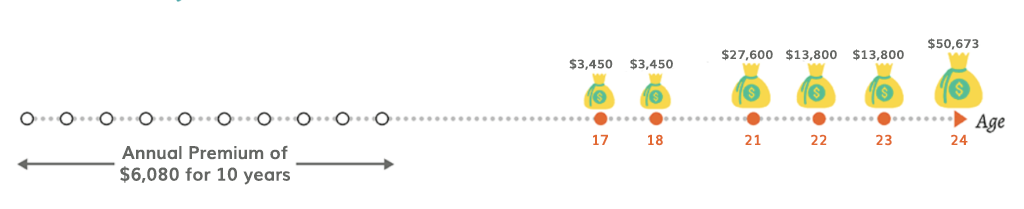

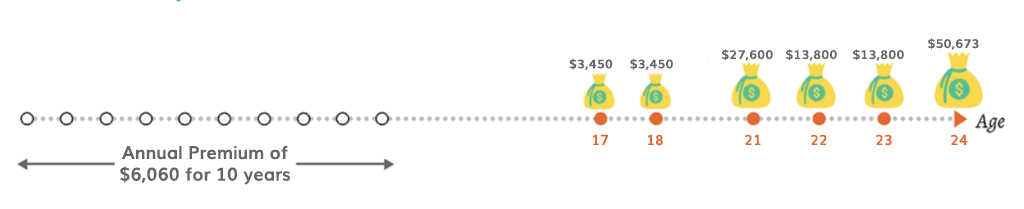

(3) Aviva MyEduPlan

(4) Manulife Educate

Here’s how the plans stack up against one other:

| Gro Junior Saver (NTUC) | Manulife Educate | Tokio Marine Kidstart | Aviva MyEduPlan | |

|---|---|---|---|---|

| Max Entry Age | 11 | 8 | 8 | 11 |

| Internal Rate of Return (IRR)* | 1.67% – 3.91% | 2.64% – 3.69% | 1.59% – 4.08% | 2.77% – 3.68% |

| Premium Duration | 5, 10, up to child turns 20/22 | 10 years | 5, 10, 15 years | 10 years |

| No. of Payouts in Uni Years | 3 (starting from 2 years before the maturity of the policy) | 4 (start at 19 or 21 years old) | 3 ( starting from 2 years before the maturity of the policy) | 4 (start at 19 or 21 years old) |

| Additional Payouts | At age 7, 12, 16, and 18 | 2 (at age 16 and 17) | None | 2 (at age 16 and 17) |

| Noteworthy Benefits | $100 per day hospital benefit for HFMD, Food Poisoning and Dengue | None | Child Benefit Waiver – all future premiums waived if child is diagnosed with autism, severe asthma, or leukemia | None |

How Should You Choose?

1. Are the returns good?

Since your objective is savings, getting a good return should be your biggest consideration. All four plans provide projected returns of more than 3.5% p.a. for the profile which we have used, which is a good return for endowment plans. However, do note that there is a range to these returns depending on the number of years you are saving for. For example, if your child is now 11 years old, and will be entering university in 10 years’ time, your expected return would fall below 3%. This is also why when it comes to saving for our goals, the earlier you start, the better.

2. Do you need the flexibility for some payouts before University age?

Think about whether you would like to have the option of small payouts at significant milestones in your child’s education journey to reward him/her with vacations or gifts, and whether you want these small payouts only closer to the University years (Aviva’s MyEduPlan or Manulife’s Educate) or even earlier (NTUC Income’s Gro Junior Saver ). If you do not need to spend the money, these payouts can always be deposited with the insurer to earn a good interest (around 3%, subject to the insurer’s discretion) and can be withdrawn anytime. Such liquidity is an advantage, but if it is not of paramount importance, you should probably consider Tokio Marine’s Kidstart instead. In return for giving up this liquidity, this plan gives the highest projected return of more than 4% p.a.

3. How long are you willing and able to pay premiums for?

NTUC Income’s Gro Junior Saver offers the flexibility to pay premiums up to when your child enters university, while the other plans have a fixed 5, 10 or 15 year premium duration. This means that you can potentially stretch your savings period longer, allowing you to accumulate more along the way, or commit to a smaller sum annually to reach the same goal.

Our Verdict

Based on the above example, NTUC Income’s Gro Junior Saver seems to be the most attractive plan, because it offers the flexibility of payouts before University age as well as the choice of premium duration, all while offering one of the highest returns of the four plans.

Do note that the most suitable plan may differ for children of different profiles (Eg. age and gender). Have a chat with one of our experts for guidance. Also, check out our comparison tool to compare the plans today!