Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Find out more about endowment policies and which policy can help you save for the future.

Endowment policies are designed to help you save for the future. You contribute a regular premium for a number of years and at the end of the policy duration, you receive a lump sum Maturity payout. Some Endowment policies have a Cash Back feature, whereby Yearly Cash Benefits are given at specified years in addition to the Maturity payout.

The rate of return from Endowment policies typically ranges around 2.0% to 4.0% p.a., depending on the type of Endowment policy, entry age and policy duration.

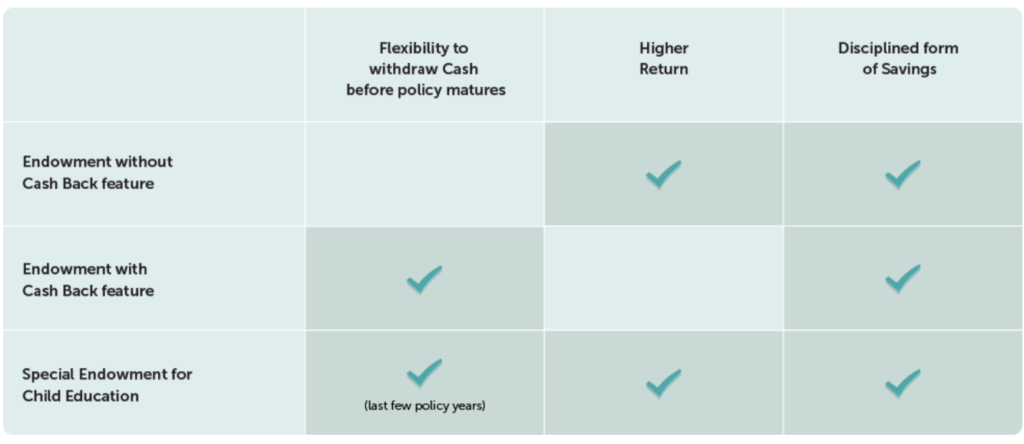

The following table highlights the various Endowment policies to meet your savings needs:

Here are some illustrations of how the different endowment plans work:

1. Endowment Without Cashback

You pay the policy premium for a number of years and in return, a lump sum Maturity payout is given at the end of the policy term. No cash benefit is given during the interim period.

The policy premium can be paid either:

- Over the entire duration of the policy (regular premium policy); or

- Over a shorter duration but at higher premium (limited-pay premium policy).

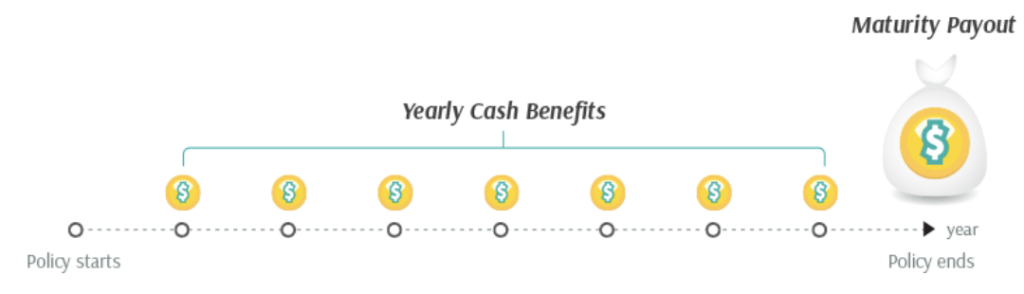

2. Endowment With Cashback

The policy premium is payable for a certain number of years. In return, you are given a stream of income, known as Yearly Cash Benefits, at specified intervals, and a lump sum Maturity payout at the end of the policy term. If you do not wish to withdraw any of these Yearly Cash Benefits, they can be deposited with the insurer to earn an interest, usually higher than what banks would pay.

Similarly, the policy premium can be paid either:

- over the entire duration of the policy (regular premium policy); or

- over a shorter duration but at higher premium (limited-pay premium policy)

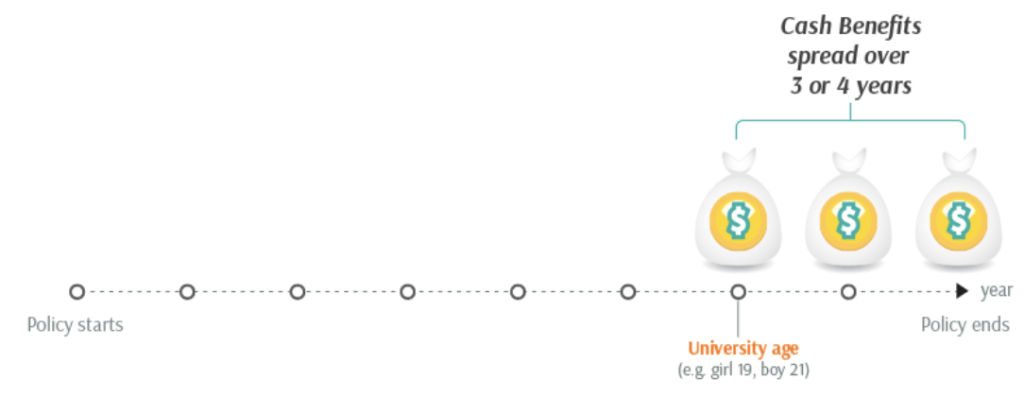

3. Special Endowment for Child Education

This Endowment is specially designed for child’s education planning. You pay the premium typically until the child reaches the age of entering university (19 for girls, 21 for boys). After which, Cash Benefits are given over the next 3 or 4 years to pay for the child’s education cost.

Some Endowment policies would even pay additional Cash Benefits (smaller amounts) at various ages such as 7, 12 and 16, to commemorate the start or end of educational milestones.

Similarly, the policy premium can be paid either:

- over the entire duration of the policy (regular premium policy); or

- over a shorter duration but at higher premium (limited-pay premium policy).