Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Having a good financial plan to secure your child’s future also takes time and effort to the layout.

Back in September 2018, NUS released a study on The Straits Times

that discussed the effectiveness of government policies in increasing Total

Fertility Rate (TFR) in Singapore. The authors found that the estimated cost of

raising a child in Singapore from infancy to age 21 across the 30th,

50th and 70th percentiles of household income was

$280,000, $560,000 and $680,000 in current dollars respectively.

As parents, we look at these numbers with amusement. Would I be a

millionaire today if I had chosen not to have any kids and do these numbers

guide my decision to have children? The answer would be no on both counts. This

is because becoming a parent has always been a life choice, not a financial one.

The responsibility and joys of parenthood cannot be measured monetarily which

probably explains why the study found that cultural influences like being born

under a good zodiac sign were more effective in raising birth rates than cash incentives.

Now, while affordability is not a factor in the decision-making,

we want to do our best as responsible parents to support our children both

emotionally and financially. Just as a good trusting relationship between you

and your child takes time and effort to nurture, having a good financial plan

to secure your child’s future also takes time and effort to the layout.

In this article, we will be sharing how you can easily set these plans in motion leveraging on government schemes and suitable financial instruments in the market that won’t cost you an arm and a leg to see your kids to university.

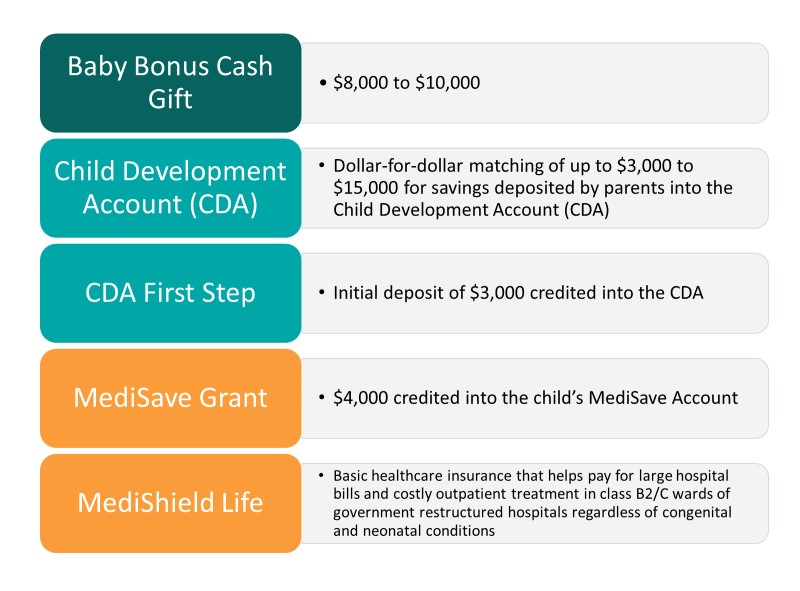

Today, upon the registration of a newborn in Singapore with lawfully married parents, they are automatically entitled to these benefits:

Meeting Your Child’s Healthcare Needs

The MediSave Grant which is credited into the child’s MediSave

Account (MA) is meant to help you defray the cost of your child’s healthcare

expenses and pay the premiums of MediShield Life. Savings in the MA earns a

high interest of up to 5% p.a. With a starting balance of $4,000 in your

child’s MA, it earns an annual interest of about $200 which is more than enough

to pay the premiums of MediShield Life until your child turns 21.

If you prefer to have the option of seeking treatment in higher class wards or private hospitals, you would need to enhance your child’s coverage with an Integrated Shield Plan (IP) which is costlier. In which case, this $4,000 should be able to last till your child turns 15 years old.

Planning for Your Child’s Developmental and Education Needs

1. Child Development Account (CDA)

Savings in the CDA can be used to pay for childcare

centre/kindergarten/special education school fees and even meeting your child’s

healthcare needs such as medical expenses at hospitals and GP clinics, premiums

for MediShield Life or integrated shield plans as well as assistive devices, eye-related

products at optical shops and approved healthcare items at pharmacies.

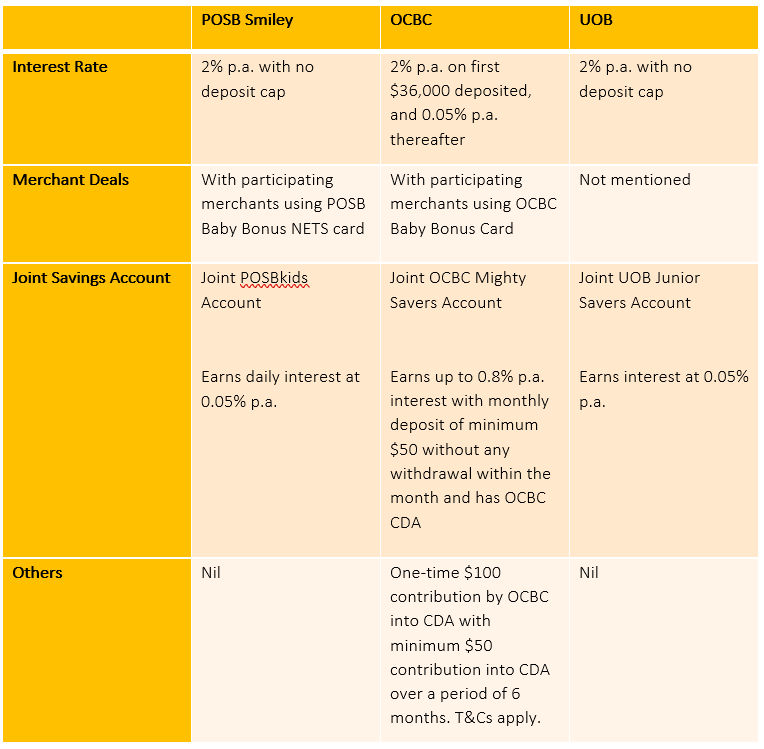

To receive the CDA First Step deposit and participate in the dollar-for-dollar matching from the government, you will need to open a CDA with any of the three local banks in Singapore – POSB/DBS, OCBC, and UOB. Based on our comparison, the CDA is largely similar in design though OCBC may have an edge over the others as tabled below.

While there is a cap of $36,000 on the 2% p.a. interest payable for OCBC, one is unlikely to hit this cap unless this is meant for your 5th child onwards. On the other hand, if you are already on the lookout for a junior savings account for your child to save regularly, the 0.8% p.a. is actually pretty decent.

Check Out Our Child Education Package

2. Edusave and Post-Secondary Education Account (PSEA)

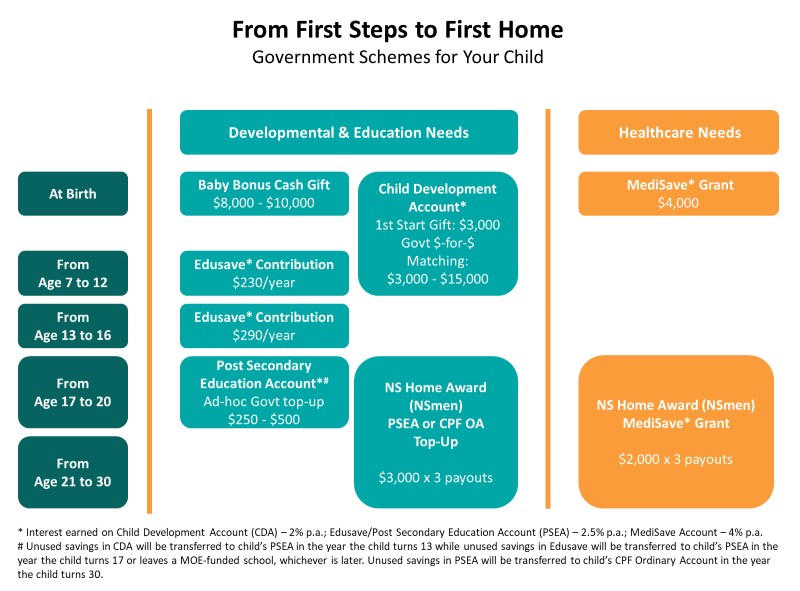

In addition to the Baby Bonus Package, there are also other

government schemes available to support your child through their education

years.

When your child enters formal education from age 7, they will also

be entitled to yearly Edusave contributions from the government, $230 for

primary school students and $290 for secondary school students. Edusave monies can

be used to pay approved enrichment programmes or fees.

Between the ages of 17 and 20, the government also provides top-up

to the child’s Post-Secondary Education Account in good years to help parents

save up for their child’s post-secondary education. As announced at Budget

2019, a top-up of $250 – $500 will be provided to eligible students.

And for our sons who serve National Service, under the NS Home

The award, they will also be given a total of $15,000 over 3 payouts upon

- Completion of full-time National Service

- Mid-way

through their ORNS cycle - Completion of ORNS cycle

Each payout comprises $3,000 credited into their PSEA or CPF Ordinary Account and $2,000 credited into their MediSave Account.

Check Out Our Child Education Package

How to maximise your CDA savings?

At first glance, these top-ups are unlikely to rock anyone’s boat.

Chances are we’ll just use whatever there is to minimise our own cash expenses.

This holds true only if these accounts don’t pay any interest. However, it may

interest you to know that your CDA, Edusave Account and PSEA earns you interest

of 2 – 2.5% p.a. risk-free so we must also consider the opportunity cost of

these options.

For example, if I spend a dollar in my CDA, Edusave, or PSEA

instead of the dollar in my bank account earning 0.05% p.a., I am in a worse

off position because I am losing out on interest. However, if I invest that

dollar in my bank account to earn a return of say 5% p.a., then using the

savings in the CDA, Edusave or PSEA would put me in a better situation since I

can gain more with the investment. In short, where possible, use monies that

earn the lowest interest rate to meet our short-term needs first.

What’s more, your child’s CDA savings and Edusave monies are

automatically transferred to their PSEA in the year they turn 13 and 17 years

old respectively. Thereafter any unused PSEA monies are transferred to their

CPF Ordinary Account (OA) in the year they turn 30 years old.

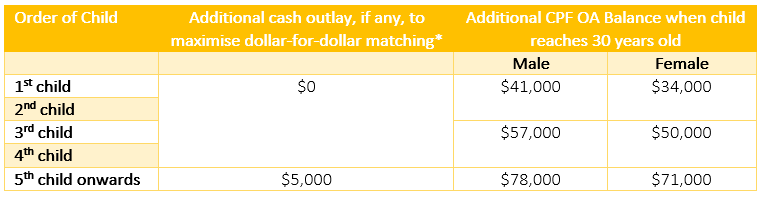

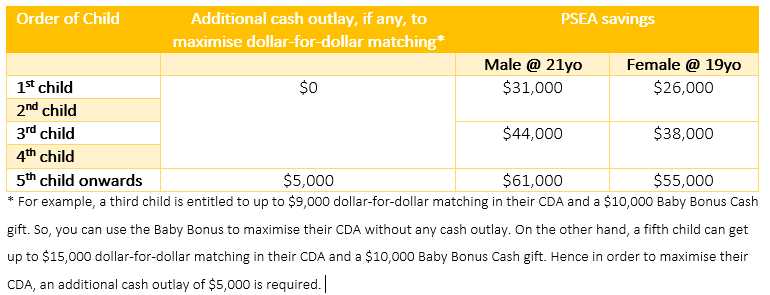

What this means is if you deposit all your Baby Bonus Cash Gift into your CDA, max out your contribution to CDA to benefit from the full government matching, and leave your child’s Edusave and PSEA monies untouched, this is roughly how much additional CPF OA your child will have by the time they turn 30 to pay the downpayment of their first HDB flat.

In the situation that you would like to use the savings in the PSEA for your child’s university education, this is how much they will have available which can pay for about 1.5 to 3 years of their tuition fees assuming your child is a newborn today.

3. CPF Education Scheme

You can also use the savings in your OA to pay for your child’s

subsidised tuition fees for approved diploma and degree courses in local

educational institutions. This is a loan scheme, however, which means that

within one year of graduation, your child will need to refund the amounts withdrawn

and the accrued interest it would have earned at 2.5% p.a back to your CPF OA.

If you are more than 55 years old and can set aside your Full

Retirement Sum or Basic Retirement Sum with sufficient property charge, you can

also, request to waive off the repayment.

Your CPF OA monies can be used for four main purposes – housing,

education, investment, and insurance. It can also be used to supplement your

retirement savings. Considering that it has so many uses, it is important to

think about how allowing your child to use your CPF OA for their education will

impact your other goals as well.

Together with the financial instruments, you can tap on to grow your child’s education funding and prudent use of these government schemes, you can focus more on nurturing your child and less on the cost of raising them. To help you make these wise decisions easier, MoneyOwl has carefully designed a Child Education Package to kickstart the planning for your child’s education needs. We also have the Child Protection Package for your child’s protection needs. Check it out and if you prefer, you can also customise it further with the help of our friendly advisers.