Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

When the market crashes, you shouldn’t cash out immediately as you may miss out on an opportunity for growth.

(13 June 2022 – 17 June 2022)

As the second week of July comes to a close, major US stock indexes fell around 5% to 6% for the second week in a row, with the S&P 500 and the MSCI World Index falling 5.76% and 5.90% respectively, posting the tenth negative weekly results out of the past eleven. MoneyOwl’s 100% equity portfolio was down 5.93%.

On Monday, there was a sharp sell-off in global equities after previous Friday’s inflation showed a 40-year high. In an attempt to curb inflation momentum, the Federal Reserve approved on Wednesday a 0.75% increase in the benchmark interest rate, making it the biggest hike since 1994 and left the Fed Funds rate at a range of 1.50% to 1.75%. Fed Chair Jerome Powell said that the Fed may slow the pace of interest rate increase in September if economic growth slows too much.

The continued heightened market volatility in the first half of 2022 was a culmination of decades-high inflation, continuing tension in Russia-Ukraine, and China’s challenges with Covid resurgence, which caused global supply chain disruption and fear of stagflation/recession in the global economy.

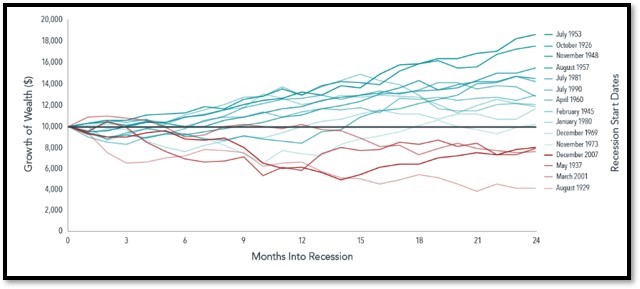

From a market perspective, we have already experienced a drop in stocks, as prices have likely incorporated the growing possibility of a recession. Investors may be tempted to abandon equities and go to cash because of perceptions of recessions and their impact. However, we would like to remind investors that historically, across the two years that follow a recession’s onset, equities have a history of positive performance.

Performance of US equities over past 15 recessions

Data provided by Dimensional Fund Advisors

The above data covers the past century’s 15 US recessions before Covid-19, and demonstrates that investors tend to be rewarded for sticking with stocks. The graph above also demonstrates that in 11 out of 15 instances, or 73% of the time, returns on stocks were positive two years after a recession began. The Covid-19 recession is excluded from the graph but we know how good performance has been since March 2020.

Recessions understandably trigger worries over how markets might perform. However, history can be a reassurance for long-term investors who are wondering whether now may be the time to move out of stocks. Think of the returns past investors would have missed out on if they chose to stick with cash in anticipation of recession or during a recession. Market events cannot be predicted with reliability, but the returns it provides over the long term are definitely much more reliable.

Avoiding recession

President Joe Biden said a US recession isn’t inevitable and acknowledged that aides warned him about the inflationary risk of his flagship relief bill. Americans are “really down” on the state of the nation, Biden said in a sit-down interview with the Associated Press. Biden signed legislation on Thursday aimed at cutting overseas shipping prices, calling the new law another move by his administration to curb inflation stuck at a four-decade high.

Unintended Consequences

Russia’s invasion of Ukraine galvanised the US, UK and EU to unleash a slew of sanctions meant to punish Vladimir Putin’s government and pressure him to pull his forces back. However, some of Biden’s administration officials are now privately expressing concern that rather than dissuading the Kremlin as intended, the penalties are instead exacerbating inflation, worsening food insecurity and penalising ordinary Russians more than Putin or his allies. So far, about 1,000 companies have announced that they are curtailing operations in Russia.

Be Exceptional

Elon Musk met with Twitter employees for the first time since signing a $44 billion deal to acquire the social network, telling staffers that they shouldn’t worry about changes to their jobs once he takes over – as long as their work is “exceptional.” At one point in the meeting, he brought up aliens and the meaning of life. His comments prompted a flurry of snarky, frustrated and concerned commentary on internal message boards, sources said. What Musk didn’t bring up was a clear, forceful intention to complete the deal. In recent weeks he has cautioned that he might walk away from the accord if Twitter doesn’t do more to prove that its user base is mostly real people and not bots.

Worker Woes

Coinbase announced it will lay off 18% of its workforce or some 1,200 workers, in another sign of a worsening crypto downturn that’s shaved off trillions of the total cryptocurrency market value. What began as a gradual downturn towards the end of 2021 has quickly turned into one of the harshest crypto winters the market has ever seen. The last two months saw three of the worst project failures in the crypto industry. It began with the Terra UST debacle in May, which tipped the markets into a nosedive. And since then, two more firms, crypto exchange Celsius and venture capital firm 3AC, have buckled under market pressures and are inching closer to insolvency.

Read more Market Insights here.

Disclaimer: While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Expressions of opinions or estimates should neither be relied upon nor used in any way as an indication of the future performance of any financial products, as prices of assets and currencies may go down as well as up and past performance should not be taken as an indication of future performance. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.