Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Time in the market will always beat timing the market. When you start and stay disciplined in investing for the long term, you will reap the benefits and be more confident even in the event of a downturn.

(12 December 2022 – 16 December 2022)

The major stock indexes fell around 2% last week, declining for the second week in a row but retreating less than they had the previous week. With a couple of weeks left in 2022, recession fears continue to weigh on the markets.

The S&P 500 and MSCI World declined 2.08% and 2.13%, respectively, and MoneyOwl’s 100% equity portfolio was down 1.34%. In Fixed Income, the Bloomberg Barclays Global Aggregate Bond Index was down 0.91%, with the US 10-year treasury yield down 11bps to 3.58%. Most of the market movements happened after the Federal Reserve meeting on Wednesday.

As widely expected, last week, the US Federal Reserve lifted its benchmark interest rate for the seventh time this year, approving a more moderate half-percentage-point increase relative to its recent three-quarter-point hikes. However, Fed officials expect to keep the benchmark rate at a higher peak level next year than many observers had forecast, and stocks mostly retreated following the announcement.

The US Federal Reserve had plenty of company in lifting interest rates by a half percentage point, as central banks in the European Union, the United Kingdom, and Switzerland also raised borrowing costs by the same amount. The UK’s Bank of England said that it believes the economy is in a recession.

If December is to end up positive overall for the US stock market, it will require a significant rebound in the final two weeks of the year—an occurrence that’s sometimes called a Santa Claus rally. Over the first two weeks of December, the S&P 500 was down nearly 6% as of Friday.

Time In The Market

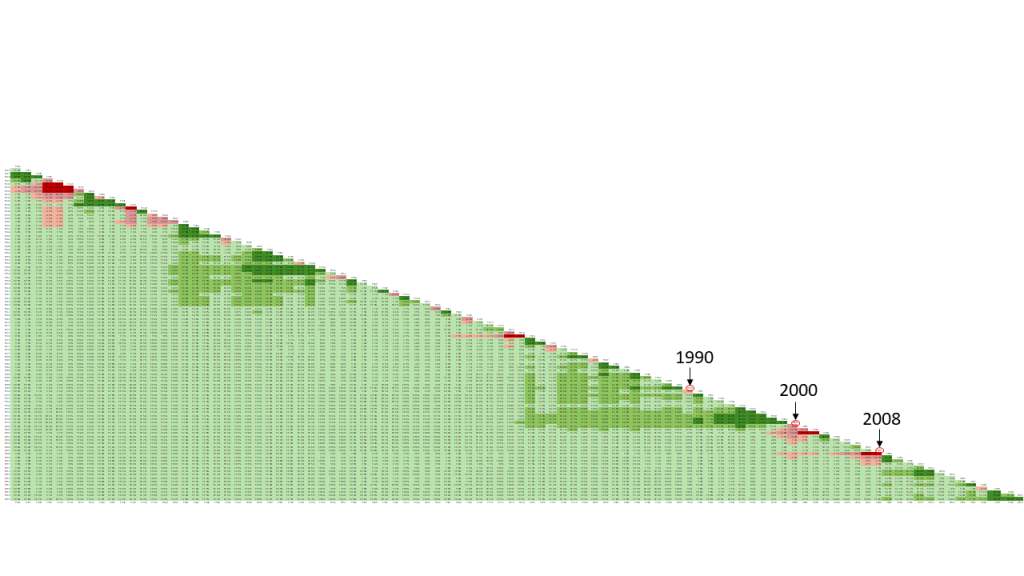

With only two weeks left till the end of 2022, it is inevitable that the market will be negative this year, something that is uncommon compared to previous years. Below we present a chart showing the annualised return of the S&P500 per year since 1990.

S&P 500 Annualised Return

Source: MoneyOwl

Here’s how to read it.

Assuming you had started investing in the S&P500 in 1990, you would have earned -3.10% at the end of the year. If you continue to stay invested for another year, your average returns will have increased to 12.4% per year. Cumulatively, you have still gained more than 20% over two years.

The worst period in the dataset would probably be during the year 2000 when the technology sector crashed. If you had started investing in the year 2000, you would have had to hold your investments for 11 years before seeing positive returns every year in your investments.

Let’s now look at what happened in 2008.

If you had started investing at the beginning of 2008, you would have suffered a double-digit negative return of 37% in that one year. But if we look over two years, it dropped to -10.7%, -2.9% in three years, and over about 5 years, returns to positive territory.

We have colour coded this chart where all the green represents positive returns, and all the red represents negative returns. As you can see, the dark patches of red only happen once every few decades. But throughout the 30-year period, as long as you can stay invested for 10-14 years, you’ll always get a positive average return.

What this means is that it doesn’t matter when you invest. You’d be fine if you were to start investing and stay invested. This gives long-term passive investors a lot of confidence because you know you don’t have to worry about crises or short-term fluctuations as long as you have time.

Now for some of us, a downturn may happen the moment we invest. What should we do, and how will this affect your ability to meet your financial goals?

This chart will give you some comfort. Even if you started investing right before the dot-com bubble burst in 2000 and stayed invested through the Global Financial Crisis – you don’t have to worry about losing money after 10 years.

What’s more, if you hold on to your investments for even longer to participate in the market recovery, your annual return over this period would have been more than 10% p.a.

This is what it means when you hear the old adage of ‘it’s not about timing the market, but about time in the market’.

Chip Control

Japan and the Netherlands have agreed in principle to join the US in tightening controls over the export of advanced chip-making machinery to China, in a potentially debilitating blow to Beijing’s technology ambitions.

The two countries are likely to announce in the coming weeks that they’ll adopt at least some of the sweeping measures the US rolled out in October to restrict the sale of advanced semiconductor manufacturing equipment. The three-country alliance would represent a near-total blockade of China’s ability to buy the equipment necessary to make leading-edge chips.

Rapid Spread

Covid is spreading rapidly through Chinese households and offices after pandemic rules were unexpectedly unwound last week. People are flocking to hospitals with mild symptoms after three years of propaganda painted the virus as dangerous, despite state media urging them to medicate at home. Meanwhile, China’s ambassador to the US said the country would continue to relax its strict Covid-19 measures and will welcome more international travellers in the “near future.” Adding on, China may drop quarantine for Hong Kong residents travelling into the mainland next month.

SBF Arrest

Disgraced FTX co-founder Sam Bankman-Fried was arrested in the Bahamas after the US government filed a criminal indictment. Bankman-Fried is being held in custody pending an extradition process, the island nation’s attorney general, Ryan Pinder, said in a statement Monday. Federal prosecutors in Manhattan plan to unseal the case against him Tuesday morning “and will have more to say at that time,” Damian Williams, US attorney for the Southern District of New York, said in a separate statement. He didn’t elaborate on the allegations.

Fed Aftermath

The Fed raised rates by 50 basis points at Wednesday’s meeting, as expected. Chair Jerome Powell says the central bank has more work to do to vanquish inflation, but investors seem to see the outlook for 2023 differently. According to their median forecast, policymakers projected rates would end next year at 5.1% before dropping to 4.1% in 2024 — a higher level than previously indicated. Stocks and bonds fell over the week as a result, and the higher terminal rate came one day after inflation data of CPI showed a cooling down, which actually helped to inject some element of surprise into the market.

The Blacklist

The US government is adding dozens of Chinese tech companies to a blacklist, ratcheting up a trade conflict between the world’s two largest economies. The Department of Commerce’s move means that anyone seeking to supply them with US technology will require a license from Washington — something that will likely be difficult to get. The US wants to limit the Chinese military’s access to advanced chipmaking and artificial intelligence technology.

Read more Market Insights here.

Consider parking your emergency funds in MoneyOwl’s WiseSaver, a cash management account now at an attractive gross yield of 4.12% p.a. (5-day moving average as of 3 November 2023).

Disclaimer: While every reasonable care is taken to ensure the accuracy of the information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Expressions of opinions or estimates should neither be relied upon nor used in any way as an indication of the future performance of any financial products, as prices of assets and currencies may go down as well as up and past performance should not be taken as an indication of future performance. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.

Follow MoneyOwl on social media for more awesome content on investments, insurance, and financial planning!