SINGAPORE, 31 MARCH 2021 — NTUC social enterprise MoneyOwl, the award-winning trusted financial adviser and fund management company, today announced the launch of Fullerton MoneyOwl WiseIncome, a low-cost, multi-asset solution designed to build passive income and capital growth to help Singaporeans build a reliable retirement income stream to supplement their CPF LIFE payouts. Exclusively distributed by MoneyOwl, and managed by Fullerton Fund Management, one of the largest asset management firms in Singapore, the fund was jointly conceptualised by the two companies to solve a gap in retirement investment solutions in the market.

According to the OCBC Financial Wealth Index 2020, a survey of 2,000 Singaporeans aged 21 to 65 found that Singaporeans are falling behind in planning for retirement. At the same time, Singaporeans’ life expectancies have also increased to one of the highest in the world – 81.4 for males and 85.7 years old for females; making the issue of adequacy of retirement income an urgent one.

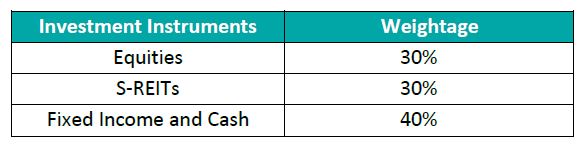

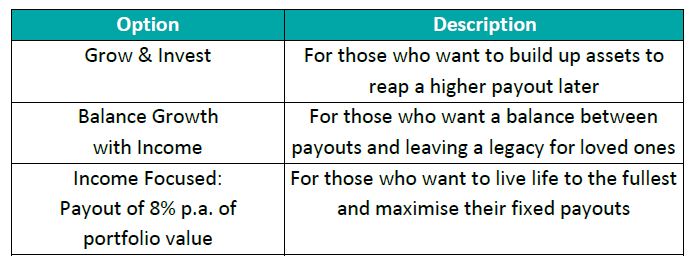

The Fullerton MoneyOwl WiseIncome aims to solve this problem by helping Singaporeans build their retirement savings throughout different stages of their lives at low cost and high flexibility. With 3 payout options, investors can choose the option that best meets their needs. With an option that can go up to 8 per cent per annum payout, this option enables Singaporeans to maximise their income stream for retirement. The fund was also designed for Singaporeans’ investment preferences in mind: the Singapore Dollar based fund includes a diversified portfolio with exposure to property through S-REITS, Asian fixed income from investment-grade companies, and global equities through low-cost passive ETFs, while keeping volatility in check through Singapore and US Government Securities.

“Last year saw many Singaporeans concerned about their daily cost of living and not focused as much on their immediate retirement planning and needs. What we have seen in our interaction with our clients is that many are not prepared for retirement, with a lack of understanding of national schemes and how to manage investment risks being a key barrier, besides the lack of suitable income withdrawal instruments. There is a need to build layers of retirement income that can last throughout one’s golden years, starting with CPF LIFE as a bedrock, and then layering an additional stream of regular income from assets that have both capital appreciation and income generation potential. We’ve designed WiseIncome with this need in mind, with options for Singaporeans starting at different stages of life in their retirement journey,” said Ms Chuin Ting Weber, Chief Executive and Chief Investment Officer of MoneyOwl.

“Fullerton Fund Management is delighted to partner MoneyOwl on this launch. As the fund manager, Fullerton draws on our award-winning investment expertise to dynamically capture opportunities and manage risks in Asian and global markets, in order to provide growth, income and diversification. We believe that Fullerton MoneyOwl WiseIncome can assist Singaporeans to build up their nest egg, while they focus on other important life goals,” said Ms Jenny Sofian, Chief Executive Officer of Fullerton Fund Management.

The WiseIncome product is just the latest of solutions designed by MoneyOwl to meet Singaporean’s financial needs under its investment service. The company’s full suite of financial services that cover a whole range of comprehensive financial planning with CPF analysis, insurance advisory, investment advisory and will writing, saw MoneyOwl grow its customer base by 259 per cent from the year prior. MoneyOwl’s services are in a Bionic Financial Advisory format – combining multiple digital platforms for 24/7 access with a large advisory team whose advisers are fully salaried and all on the internationally recognised Certified Financial Planner (CFP) programme.

“We aim to make wise financial decisions easy for all Singaporeans, by providing trusted advice augmented, at lower costs. This is our social mission. Our philosophy has always been to start from a financial planning need, like retirement, and then carefully curate – or even co-create – the best solutions that can meet these needs at a low cost. By focusing on reliability and sufficiency, rather than chasing the latest investment fads or fancy product features, we help Singaporeans fulfil their key life goals such as a meaningful retirement. Our success thus far has shown the relevance of this model, and WiseIncome is the latest iteration of this approach.” said Ms Chuin Ting Weber.

In a survey conducted by the company of its users, in the area of investment, 34 per cent of the respondents said that low fees were the main reason why they chose to invest with MoneyOwl, followed by 24 per cent and 22 per cent respectively cited underlying funds and trust in the brand as an NTUC social enterprise and an associate company of Providend, one of Singapore’s oldest retirement specialists.

Investors can use cash and their Supplementary Retirement Scheme (SRS) to invest in the fund with an initial investment amount of S$1,000 or set up a regular savings plan of at least $100 per month. There is no lock-in period or sales charge for this fund. Fullerton’s fund management charge of 0.40% p.a. is also among the lowest in the industry for such quality multi-asset funds, compared to the industry average of 1%. Unlike many Singapore unit trusts, the fund does not pay any trailer commissions to MoneyOwl or any platform provider, and this helps to keep expenses low.

The Fullerton MoneyOwl WiseIncome’s portfolio will be held in the following weightages:

Investors can also choose one of the following options that best meet their financial needs when investing with WiseIncome:

Announcement: With effect from 1 June 2022, MoneyOwl is a 100% NTUC Enterprise (NE)-owned company.