Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Should you be overly worried about inflationary pressures?

As the mother of an almost-five-year-old, the word “inflate” conjures up primarily images of birthday balloons and a mild feeling of dread of blowing them up, rather than anything to do with markets. You want to put enough helium from that tank you had rented into the balloon, to get over that critical point of rubbery stretch to a beautiful roundness. The kid, of course, demands faster and bigger. The expectation is to repeat this a dozen times for some party fun. But over-do it, and the thing bursts in your face, painfully. Even if you get the gaseous volume just right, you need to hang on to the balloon and be dexterous enough to tie that knot and ribbon lest it whizzes out of your hand in a random flight of the hummingbirds.

But perhaps it isn’t that different in economics.

Central banks and government authorities around the world have faced down the threat of deflation with massive stimulus over the past 13 years. Inflation is not something you worry about when the alternative is deflation, which is linked to that other horrifying D-word, depression. When the Global Financial Crisis hit in 2008, governments dealt with deflation risks mainly through monetary policy: cutting interest rates, expanding the money supply, and saving the banking system through which money is multiplied through borrowing. Inflation has since remained muted despite fears over an expanded money supply. When the deflation threat reared its head again last year with COVID-19, central banks again did their part in deploying their arsenal of monetary policy tools, even buying up corporate debt. To complete its support, the Fed introduced a new policy framework last year to tolerate an overshoot in the targeted 2% p.a. increase in core Personal Consumption Expenditure (core PCE) for a longer time, in order to allow fuller recovery to full employment. The difference this time around is the added boost of massive Government fiscal stimulus, putting money into the hands of households and replacing wages, for the sheer political, economic, and social necessity of it, running up huge deficits.

Together with the promise of controlling COVID through a robust vaccination roll-out, this plan seems to be working well. The balloon is filling up and taking shape. Company earnings are beating expectations. People are returning to work. Very quickly, however, we have swung to anxious talk of inflation to start worrying about things bursting, as the price gauges for April and May started to get published. In the US, the headline Consumer Price Index or CPI printed for April at 4.2% year-on-year and core CPI excluding food and energy at 3.0%; while PCE reported for Apr printed at 3.6% and core PCE (Fed’s gauge) at 3.1%*. For May, US CPI was at a higher 5% and core CPI at 3.8%, the highest since August 2008. Inflation numbers for the Eurozone have also come in higher than expected.

*CPI measures the prices of goods of a certain basket over time. PCE estimates personal spending increases in various categories, and allows for substitutions of a person’s basket of foods from month to month – e.g. to eat chicken instead of beef.

The Debate

Are we in danger of overheating, or are fears of inflation, over-inflated? The debate is ongoing and heated. For weeks now, we have had never-ending analysis, forecasting, and talking by big-name economists, fund managers, and analysts, with financial news absolutely loving it and stoking the controversy and concern.

To summarise, there are largely two camps:

- The group that is alarmed about an inflationary outbreak thinks that pandemic stimulus is overheating the economy and point to how inflation gauges are the highest in a decade or two (depending on which), and how core PCE has overshot the Fed’s target of 2% by too much. Recollecting the inflationary 1970s, they are afraid that the Fed will act too late and then correct too sharply, causing prolonged stagflation.

- The other group comprises the Fed, which is officially dovish and has stuck to its new policy framework of allowing some overshoot in core PCE, among others. That wages are rising among the lower-income is a good thing. Together with the base effects of the recovery from COVID and supply-chain pressures, those in this camp believe high inflation is largely transitory and fundamentally healthy for now. The Dallas Fed has calculated a “trimmed mean” PCE (which excludes or trims out the largest-swing items) of just 1.8% y-o-y. The market seems to agree: break-even yields (difference between the yield of a nominal bond and that of an inflation-protected one of the same maturity) are moving faster in the two-year space than the 5 or 10-year, indicating that this is a short-term phenomenon and not the beginning of a new era; and 10-year yield at about the 1.60% handle (or lower) says the same.

In the financial markets, when experts disagree, anxiety rises, and the worry is then compounded by purveyors of news, talks, advice, and superior investment strategies. Yes, inflation is an important consideration for investors concerned with preserving the purchasing power of their savings over time. But the more near-term concern is that central banks will be spooked enough to tighten monetary policy and thus cause stock markets to fall big time. That there has been some talk of tapering bond purchases among Fed officials has added to concerns. The thinking goes that whichever camp is smarter can outguess price movements and out-manoeuvre the market by good timing to either avoid drawdowns or catch some “false” dips.

Inflation and Markets

What happens to markets when inflation becomes a problem? For the US, historically, the worst inflationary period in recent memory was from 1973-1981. CPI started to print consistently in low single digits from 1982 onwards, with the exception of 6.0% in 1990. Many analysts point to OPEC and the oil crisis as the trigger for cost-push inflation starting in 1973. However, others have put the responsibility for the long-drawn-out stagflation and economic slowdown on tightening by the Fed – the same concern being flagged by the worried camp today.

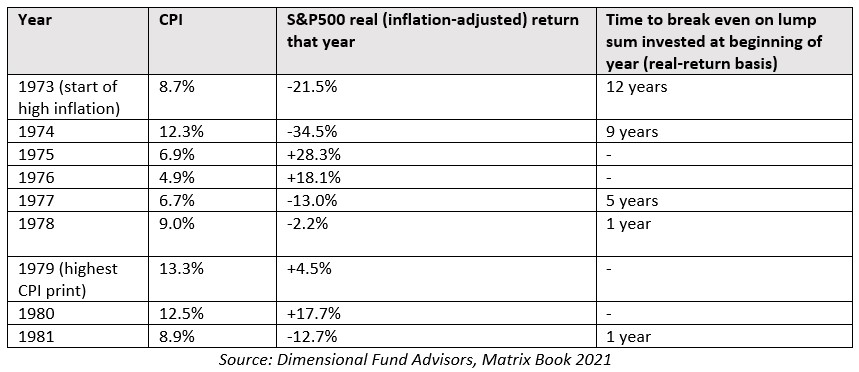

Let us take a look at the historical performance of the S&P500 during this time, for a one-time investment made at the start of each of these “bad” inflation years.

For the two most unfortunate start points (1973 and 1974), it took 9-12 years for a lump sum investment to break even, net of inflation. This is consistent with MoneyOwl’s guidance for investors who wish to be in a 100% equities portfolio to have a time horizon of 10-15 years, based on the historical performance of markets. These are not magic numbers, but it gives the long-term investor some degree of comfort. In the example, we did not factor in dollar-cost averaging, which is a more common way of investing and which could change the breakeven thresholds; nor adjustments to the investor’s personalised CPI or PCE based on his basket of goods.

However, what is counter-intuitive and remarkable, is that despite the inflationary environment, an investment took less than 5 years to break even on a real return basis in 7 out 9 years, or 78% of the time. In 6 out of 9 years, you break even within a year. More intriguing is that in as many as 4 years, investments started at the beginning of those years have not lost money since. This includes investments deployed at the beginning of the worst the inflationary year of 1979.

Our little empirical study of US inflation vs. markets tells us that:

- There is no relationship between contemporaneous inflation and an investor’s long-term experience, or even in any single year. In fact, you can be handsomely rewarded by markets even during a period of very bad inflation.

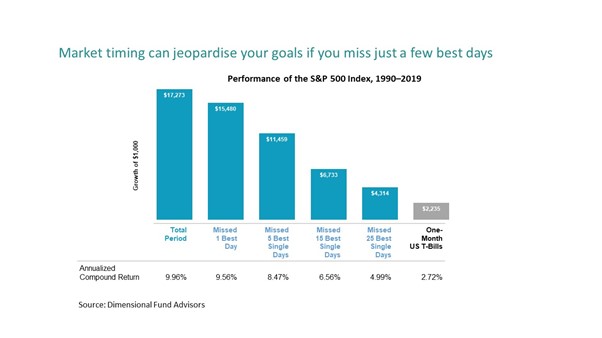

- The odds of a positive return from being invested and staying invested are much higher than trying to time the market. Staying invested is valid even in inflationary and uncertain times.

- Having a line in the water to capture an outsized return if it comes along can cushion you against cumulative losses into the long term. We do not want to miss those years by timing the market, because it matters to our overall, cumulative return.

- There is a case for Dollar Cost Averaging during times of severe economic dislocation because it means that your total return will not be the worst-case and you will also catch the good years. The regular saving plan (RSP) way of investing out of your monthly income, which is what we recommend for our mass market accumulation clients, has benefits beyond the formation of a good financial habit.

This walk down a “scary” memory lane supports what we already know about markets: that asset prices move quickly to incorporate all expectations and information about inflation and its potential impact on interest rates and equity prices. This is also indeed, a random walk. There is a randomness to year-on-year return and any investment approach built on trying to outguess markets repeatedly is quite futile.

What’s the Bigger Risk?

Nobel laureate Eugene Fama was recently asked by Dimensional founder David Booth if investors should change their portfolios in view of inflation risks. Prof. Fama said the following.

Market timing is risky in the sense that you’ve always emphasized: You may be out of the stock market at precisely the time when it generates its biggest returns. The nature of the stock market is you get a lot of the return in very short periods of time. So, you basically don’t want to be out for short periods of time, where you may actually be missing a good part of the return.

I think you take a long-term perspective. You decide how much risk you’re willing to take, and then you choose a mix of bonds, stocks, Treasury Inflation-Protected Securities, and whatever else satisfies your long-term goals. And you forget about the short term. Maybe you rebalance occasionally because the weights can get out of whack, but you don’t try to time the market in any way, shape, or form.

So, should we worry about inflation? As consumers, we might want to keep an eye on it. The steps we take to mitigate these risks would be on the short-term financial planning side of things, such as controlling expenses to save more surplus regularly to build a larger buffer.

But as investors, the outlook on inflation and short-term data, in general, should not change the way we invest for the long term. The real risk is succumbing to the temptation of market timing out of fear, greed, or hubris, betting our family’s and our life goals on one set of guesses turning out over another. Whether or not inflation fears are overstated, it is only over-inflated egos who would claim to be able to predict when inflation would hit, in which direction, and by how much interest rates or stock prices would move. It would also be far too stressful a way to invest.

So as I celebrate my daughter’s fifth birthday next week, we’ll go for just one or two balloons this time; we can’t have a party anyway with the COVID restrictions. And I’ll let the shop do the balloon inflation job with the helium, so I don’t have the stress. Her university education fund, however, we’ll build up consistently, harnessing the power of markets and keeping it safe from the vagaries of prediction, fads, and hubris. That’s a much more comfortable and reliable way to invest in what’s important.

Disclaimer: While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples, and other information presented are for reference only and are not meant to be a substitute for professional investment advice. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness, or correctness. Expressions of opinions or estimates should neither be relied upon nor used in any way as an indication of the future performance of any financial products, as prices of assets and currencies may go down as well as up and past performance should not be taken as an indication of future performance. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.