Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

At our recent MoneyOwl investment symposium, someone from the audience said that he had been doing a recurring savings plan of $300 per month since Jan 2020 into our 60/40 balanced portfolio, but currently, his portfolio is in the red, and he asked when it will turn around. I thought it was a great question because it reflects the real anxiety faced by our clients and how a trusted financial adviser like MoneyOwl could provide assurance during these times. First, he needs to be congratulated for sticking to a savings plan throughout all the noise in the market. With so much going on over the last three years or so, it might have been tempting to stop, but he didn’t. I would like to think our constant effort to impart knowledge and encouragement to our clients to stay disciplined through various market conditions is paying off.

Inflation And Interest Rate Hikes Dominate Headlines

While the markets had a great run in 2021, this year was a different story, with inflation and interest rate hikes dominating headlines. Just this week, the November CPI for the US posted its smallest increase in more than a year and landed at 7.1%, indicating that the worst of inflation might finally be over. The anticipated 0.50% rate hike by the Fed on Thursday broke the sequence of four consecutive 0.75% hikes, taking the benchmark rates up to 4.25%-4.50%, the highest in 15 years. However, observers who were hoping for a pivot soon would be left disappointed as the Fed adopted a ‘higher for longer’ stance and warned of more rises to come. Policymakers are now expecting rates to hit 5.1% on average before the inflation battle ends.

Taking Drawdowns Into Perspective

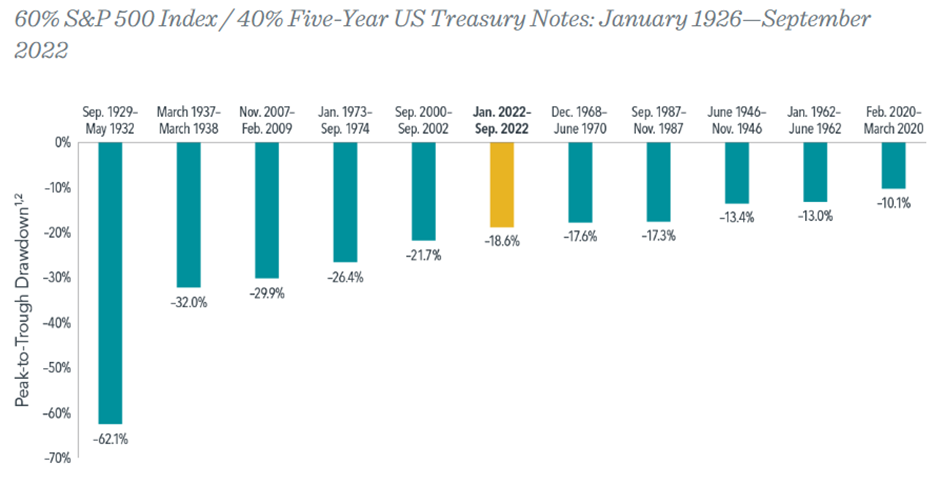

News like the one above has stoked fears of a recession and resulted in declining equity valuations. More surprisingly, the Fed’s steep rate hikes also led to deep paper losses in bonds not seen since the 1920s. Despite this, if you take a look at the chart below, the returns of a typical 60/40 portfolio in the first three quarters this year did not even crack the top five historic drawdowns in the last century and is only two-thirds of what investors endured through the financial crisis of 2008–2009.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Throwback: Market Performance After Large Declines

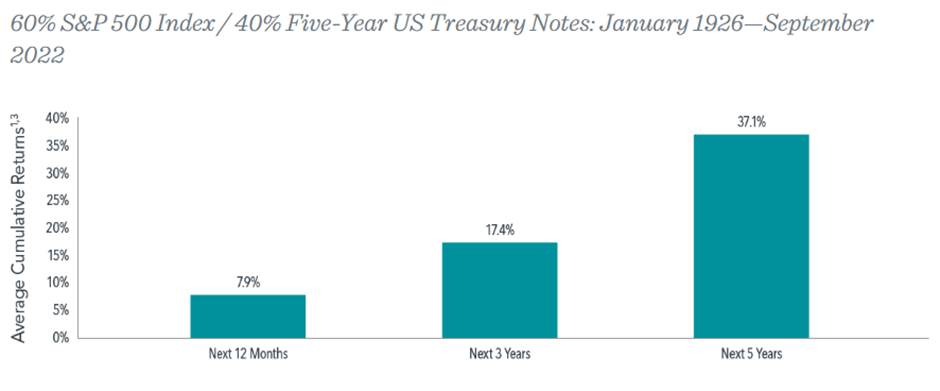

So, to the point raised by the member of the audience at the symposium, where does it go from here? To answer that, let’s review the performance of the same 60/40 portfolio following declines of 10% or more since 1926.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

From the chart above, we see clearly that returns on average have been strong in the subsequent one-, three-, and five-year periods. History makes a solid case for investors to stick with their longer-term plan and should help serve as a reminder that large drawdowns shouldn’t derail investors’ progress toward reaping the expected benefits of investing. Markets have proven quite resilient over the long run, but if history is any guide, there’s reason to believe that the portfolio of the client from the audience is alive and well and could be poised to deliver healthy returns going forward. And for all of you, if you have been saving up your dry powder or setting aside spare cash for investment opportunities, consider deploying some of it into globally diversified portfolios and let the market do the work for you.

Plan On Following Your Own Plan

As we head into a new year, you will no doubt start to hear many different experts talk about their outlook on what to invest. However, keep in mind that they don’t know who you are, or what your aspirations and goals are. Their comments do not take into account your time horizon, risk appetite, or anything that is personally related to you. So beware of taking financial cues from people who have a different agenda from you. Ultimately, investing is rarely an end in itself, but is to support realising your personal life goals. For this reason, MoneyOwl not only offers well-researched portfolios that rely on time-honoured investment strategies, but we are people-first and will walk by your side to help you build financial security and pursue long-term success.

As we end the year, on behalf of MoneyOwl, I would like to wish you a Merry Christmas during this holiday season, and a time of thanksgiving and joy ahead.

With warmest regards,

Harry Ch’ng, CA, CFA

Chief Financial Officer/ Deputy Chief Investment Officer

MoneyOwl

If you would like to have someone to guide you along your financial journey, speak to our friendly client advisers here.

Disclaimer:

While every reasonable care is taken to ensure the accuracy of information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Expressions of opinions or estimates should neither be relied upon nor used in any way as indication of the future performance of any financial products, as prices of assets and currencies may go down as well as up and past performance should not be taken as indication of future performance. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.