Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

Need clarity on the latest changes to the CPF system? We’ve got you covered.

On 1 November 2021, Minister of Manpower Dr Tan See Leng announced a slew of changes to the CPF system with the aim of simplifying procedures for receiving retirement income payouts as well as topping up of CPF accounts. In case you are not sure how you might be affected by these changes, we’ve done a breakdown of what each of the changes mean for you.

If you are looking to grow your CPF savings

The most exciting change announced would be the simplification of the MediSave top-up rules. From 1 January 2022, you can top up your and your loved ones’ MediSave account up to the Basic Healthcare Sum and enjoy tax relief of up to $16,000 per year. However, do note that this tax relief cap is shared between top-ups to Special and Retirement Account as well.

You may ask – which account should I top up first then? It really depends on your goals and priorities. Topping up the Retirement Account (which means you are at least 55 years old and above) means a higher CPF LIFE payout, which you can start to draw from 65 years old. The time when you can finally enjoy the fruits of your labour is near and would be an attractive proposition while earning higher risk-free interest on your monies.

If you are younger than 55 years old, topping up your Special Account could be likened to buying a 20 or 30-year single premium endowment plan where you’ll only reap the benefit much later. If you don’t mind the loss of liquidity, building up your Special Account as quickly as possible to at least the Basic Retirement Sum ensures that you would have secured your basic retirement payout, giving you greater assurance to invest or grow your monies in other market-based instruments.

What’s more, as the Basic Retirement Sum is expected to grow at 3% per year and your Special Account earns interest of 4% per year, this means you should have no issues achieving the Basic Retirement Sum by age 55, giving you the ability to withdraw excess funds from your CPF by then.

If you prefer greater liquidity with your savings, you may prefer topping up to your MediSave instead. Monies in your MA earns the same 4% interest per year but gives you greater flexibility to use these monies to pay for your and your loved ones’ medical bills and insurances such as MediShield Life, CareShield Life and their respective supplements. In addition, once you hit the Basic Healthcare Sum, any further contributions to your MediSave from your job will naturally overflow to your Special Account to help you save faster for retirement! A neat way to kill two birds with one stone.

If you are between age 55 and 70 and still working

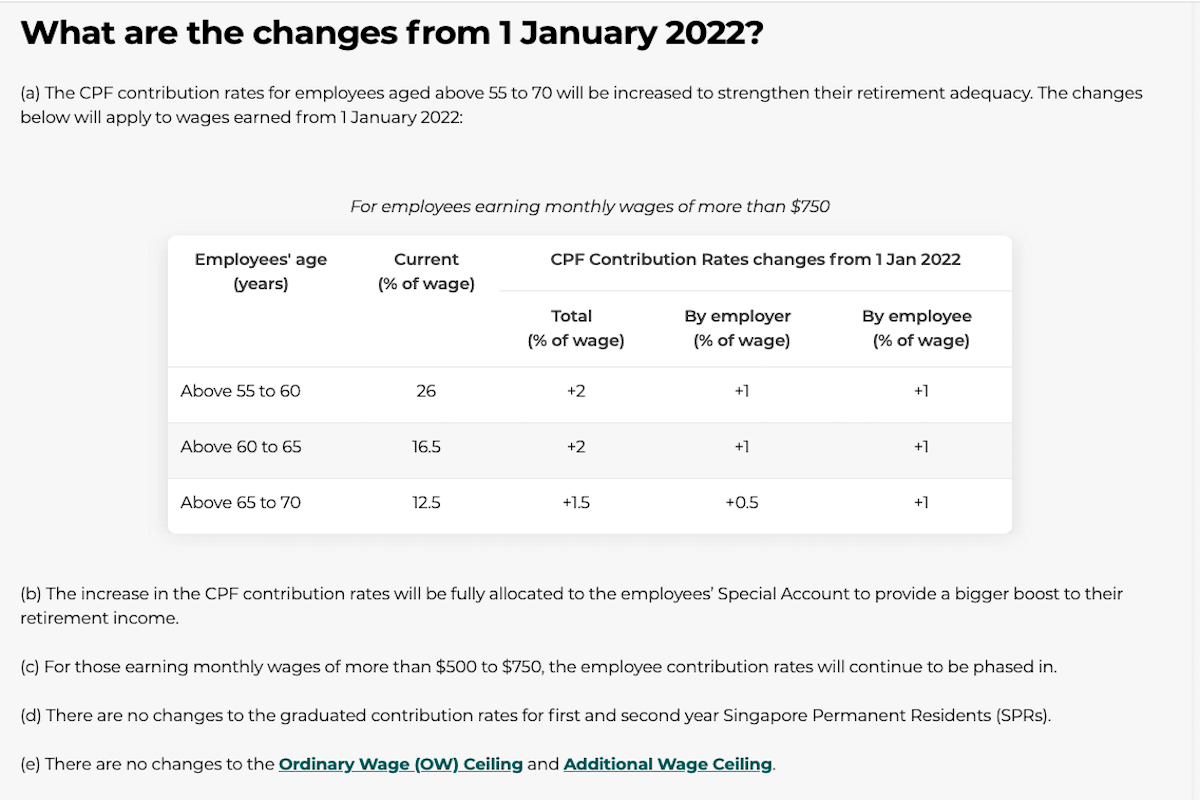

The CPF contribution rates will be increased by 1.5% to 2% from 1 January 2022 for those aged 55 and 70 to boost their retirement savings. These additional contributions will come from both employer and employee and will be fully allocated to your Special Account. If you have already attained the Full Retirement Sum (or Basic Retirement Sum with property) by then, all these new contributions can be withdrawn anytime, or you can simply leave them in your account to continue growing with interest.

If you have yet to achieve the Full Retirement Sum, then these additional contributions will give you a boost so that you can receive higher lifelong payouts through CPF LIFE.

In the same vein, the statutory retirement age and re-employment age will be increased to 63 and 68 respectively by 1 July 2022. This gives workers greater assurance that they can work longer while being protected by the various employment laws. Taken positively, this isn’t about working until we die but rather having the option to do so, as keeping our minds and body active in light of increasing longevity is fundamental to aging gracefully. Rest assured the increase in the statutory retirement age and the re-employment age have no bearing whatsoever on when you can withdraw your CPF savings.

If you are already receiving or going to receive payouts from your CPF

These CPF changes will make it easier for seniors to receive payouts from their existing CPF balances instead of having to apply for the withdrawal or higher monthly payouts. Based on my own experience dealing with my parents and technology, I believe this will certainly save many seniors much frustration while ensuring they get the payout they need for their living expenses.

If you are on the Retirement Sum Scheme and have already depleted your Retirement Account, the Board will automatically stream out any balances you have in your OA and SA accumulated from working contributions or interest in monthly payouts from first quarter of 2022.

If you are on the CPF LIFE scheme, any future top ups into your Retirement Account after you have started your payouts will automatically be annuitised into CPF LIFE to give you higher lifelong monthly payouts.

If you have yet to achieve your Full Retirement Sum post 55 years old, CPF Board currently performs a second transfer from your SA and OA accounts to your RA when you turn 65. Moving ahead, from 2023, this transfer will only take place when you start your payouts instead.

You may also realise that these changes mean that it gets harder for you to use CPF as a legacy planning tool, which was never the intent anyway. CPF system was designed to help you save and accumulate for retirement and then to disburse a monthly payout for your living expenses till end of life. It is not designed for you to store and save monies in the account to earn the risk-free interest so that you can pass on substantial wealth to your next generation.

If you are a beneficiary of your loved ones’ CPF savings

The last set of changes streamlines the disbursement of CPF savings of deceased CPF members to their next-of-kin.

For account balances not exceeding $10,000 and with no valid CPF nomination, a beneficiary representative can apply to the Public Trustee office to receive all these monies on behalf and with consent from the eligible beneficiaries. This will help cut down the time required for disbursement from up to several months or years to just a few weeks. This ensures that those who need the money urgently in absence of their provider can be provided for.

For accounts with SingTel Discounted shares and a valid CPF nomination, nominees now have up to 6 weeks to inform CPF Board of their wish to transfer these shares to their own CDP account. If they do not do so, these shares will be liquidated and disbursed to nominees as cash according to the CPF nomination.

For unclaimed monies where nominees decide not to come forward and claim the monies due to them for whatsoever reason, CPF Board will transfer these savings into a holding account that earns no interest after 6 months of notification of member’s death. This is down from 7 years previously, during which these unclaimed monies continue to earn interest until they are claimed. If you’re not sure if you are due any monies, check out this website for the unclaimed monies held by CPF Board.

If you need help with understanding how CPF and other national schemes fit in to your overall financial plan, why not speak to a MoneyOwl adviser? Our Comprehensive Financial Planning service includes a proprietary CPF Analyser to help you visualise your CPF balances in your future years, in addition to actionable tips on how to improve your cash flow, protect your assets and income, fund your children’s education, grow your wealth, optimise your CPF for your retirement and pass assets efficiently onto your heirs. MoneyOwl’s pool of qualified advisers are all fully salaried, which means they don’t earn on commission. You can rest assured that the advice you get is unbiased, conflict-free and has your best interest at heart.