Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

How MoneyOwl combines the best of human wisdom and technology with our investing philosophy

Was last week the time of reckoning for the stock markets? For those who worry that investors have been irrationally exuberant, two pieces of news over the past week might make them seem right.

The first is the market sell-off in technology stocks towards the end of the week. The US S&P500 fell 2.3% in its worst week since June and the NASDAQ by 3.3%. Technology stocks were the very same stocks that had driven the massive recovery from March. Before this turmoil, the S&P500 was up 11% for 2020 – a bewildering year-to-date performance to many given the depth of the COVID-induced economic recession across countries. Without Apple, Amazon, Microsoft, Facebook and Alphabet (Google), that return would have been less than 1%.

A second piece of news is closer to home and feels more right-brain than the left-brain. It was brought to me by a fellow CEO of another NTUC social enterprise, that Korean boy band BTS’ backer, Big Hit Entertainment, was filing for an IPO at a whopping 80 times P/E ratio, similar to that of content platform Netflix. The relevance for investors is that there are certain winning companies of the current times who can command top prices in markets.

How should investors think about what has been happening? Let’s take a small step back. The particular instance of the technology sell-off was actually preceded by a huge run-up last month when investors, including large funds, had been buying up options and stocks enticed by stock splits at Apple and Tesla (though Tesla is not in S&P500) and the exuberance spilling over into technology stocks in general. That a fast snap-up is followed by a sharp correction, just means that there are some technicals embedded in the price movement.

But this does not answer the underlying anxieties that many investors may have about the stock market volatility, which is harrowing and unsettling. Is the dominance of technology stocks and content platform stocks a bad “new normal” that has made stock investing permanently “overvalued” and out-of-sync with fundamentals, such that we should just not invest or sell and stay on the side?

At MoneyOwl, we always encourage investors to look beyond the noise of short-term fluctuations and to examine all claims and questions about a “new normal” against both market logic and evidence over time. You can call this a scientific approach to investing – and indeed it is based on the work of Nobel prize-winning economic thought which backs MoneyOwl’s portfolios. Two lessons here from evidence and logic:

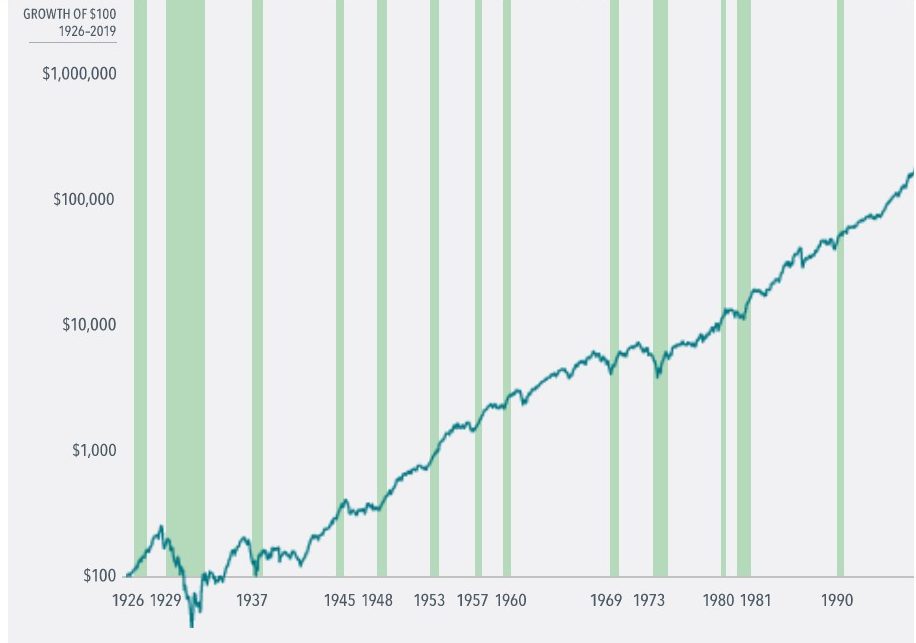

First, markets can reward investors even during times of severe economic activity slowdown. The evidence is in stock market behaviour across a century of economic recessions. The market almost always bottoms out before the fundamentals and most importantly, always recovers from a crisis – be it a depression, war or financial crisis – and goes up in the long term. What about the logic? The logic is that markets are forward-looking and reflect market participants’ collective expectations for the future, whereas news and data are about the current and the past.

Growth of investment across US economic downturn (shaded areas represent recessions)

Source: Dimensional Fund Advisors. Stock returns are represented by Fama/French Total US Market Research Index. GDP calculations are based on quarterly data from the US Bureau of Economic Analysis; quarterly data not available prior to 1947. Percentage change in GDP based on business cycle peak to trough quarter as reported by National Bureau of Economic Research (NBER).

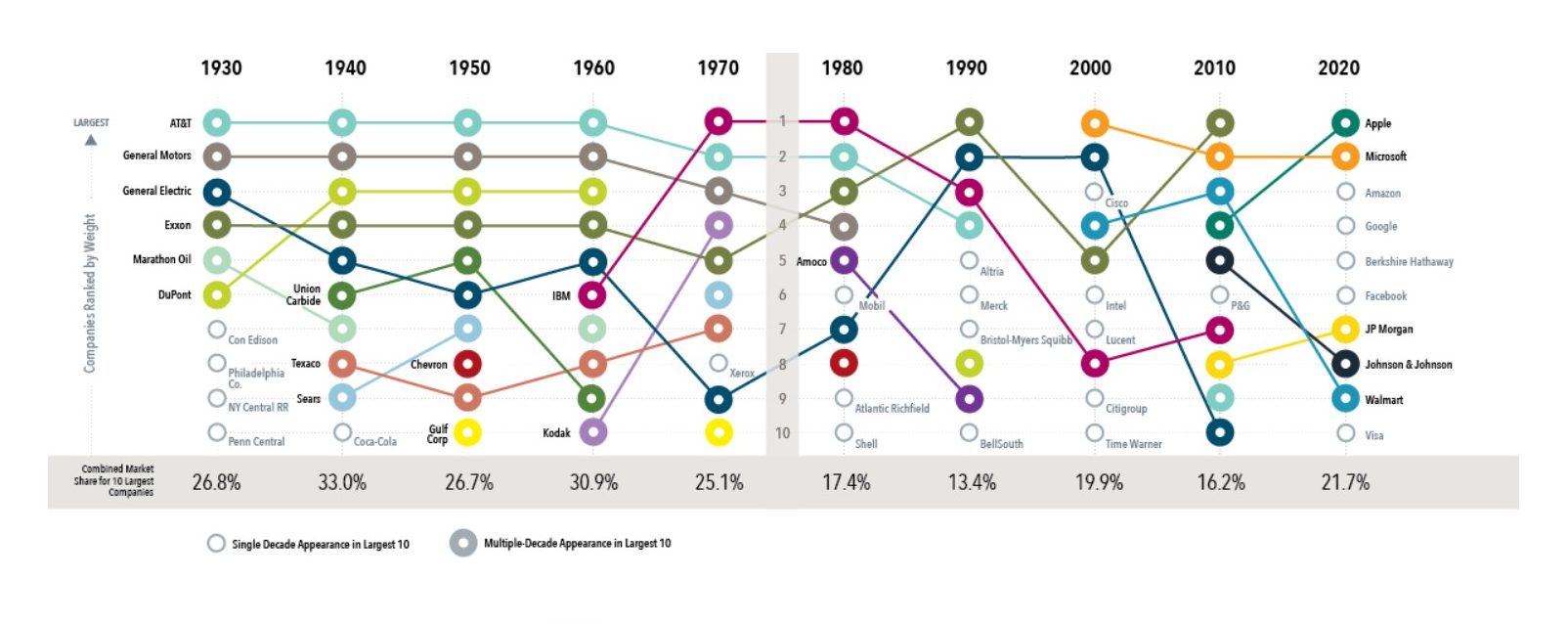

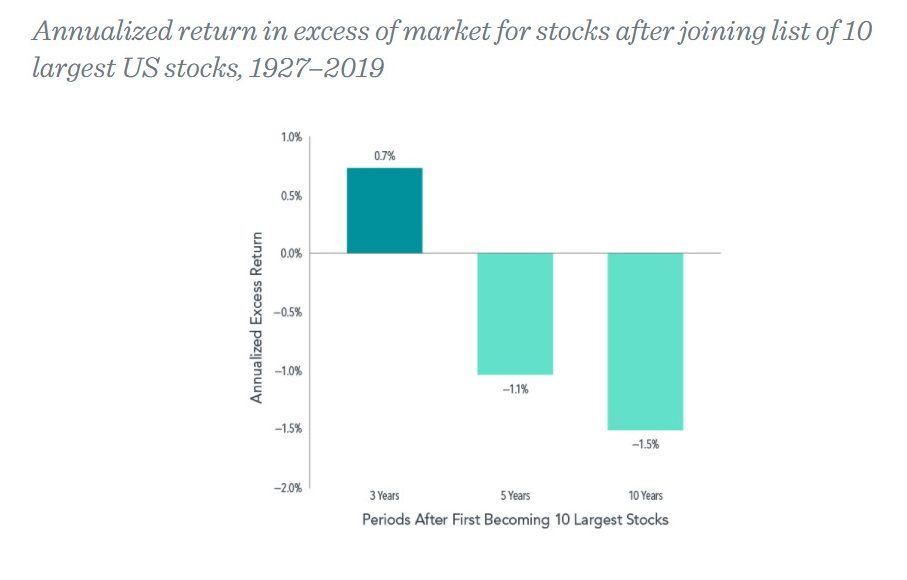

Second, the dominance of the market by a few stocks or sectors is nothing new and should not worry investors in broadly diversified market-based portfolios. You will still be rewarded! The evidence shows that different sectors take turns to dominate the stock market, as we see in the chart below. It just happens to be Technology’s turn this decade. However, beware that top stocks do not always continue to be top performers.

Largest US Stocks Over the Decade

Source: Dimensional Fund Advisors

Stock Performance of Largest 10 US stocks

Source: Dimensional Fund Advisors

What is the logic? Well, when you invest in the S&P500, you aren’t just investing in a bunch of numbers. You are investing in real companies, and during different economic circumstances, some companies fail but some companies thrive. Are you reading this article on an iPhone or an Android phone? A MacBook or a PC laptop? Did you watch Netflix during the COVID-19 circuit breaker? Did you order McDelivery? If you had stayed invested in the broad index, you were investing in these companies. The companies that thrive tend to be the most innovative of their time, but the markets are forward-looking and anticipate changes to who these next champions would be, so it is not always the same guys forever.

How, then, should investors respond to the two lessons above?

- You stay put. Stay invested in the portfolio with the correct asset allocation through the ups and downs of both the economy and the stock market. The work is done before volatility happens. The most important determinant of the variability of returns to any investor is your asset allocation, the split between asset classes such as equities and bonds. This work of asset allocation according to your need, ability (including time horizon) and willingness to take risks should have been done for you by your advisor.

- Always be globally diversified to catch the winners at any one time. We cannot tell whether Technology will always be the one on top and how long any winner would stay on top. Diversification is more than risk management. By buying the whole market, it enhances the reliability of returns by making sure that you always hold the winners of the day without having to guess who they would be tomorrow. Don’t put all your eggs in one basket. Enjoy the Korean boy band the right way. If they make your heart palpitate, it should be because of the artistes and not because of what their stocks are doing!

- Maintain faith in logic and evidence-based investing in such dimensions that provide higher expected return over time. Based on Nobel prize-winning research, these dimensions are backed by valuation logic, they are pervasive and observed over time, but require no forecasting or picking of which sectors or stocks would win – an exercise that is almost invariably futile. There are three dimensions of such return: value, small caps and profitability. Funds from Dimensional Fund Advisors, a large US fund manager of US$514b in AUM, implement these dimensions in their funds which are the building blocks of MoneyOwl’s portfolios.

MoneyOwl’s investment advisory service embodies these three approaches. We put you in a portfolio with the right asset allocation for you using our roboadvisory platform, but when it comes to times of market volatility, our team of AWP/CFP-certified advisers provides the risk-coaching that can only come from humans as we are speaking to human emotions that affect investment actions. We do not shift asset allocations tactically but stay true to them throughout economic and market turbulence. Our portfolios are globally diversified, as we use broad market-based funds from Dimensional Fund Advisers that invest in the core markets so you always have some exposure to the winners of the day. At the same time, these funds tilt towards the dimensions of value, small caps and profitability so that you can, over time, harvest the premiums of higher expected returns that have been proven by financial science to be logical and pervasive.

So, you can rest assured that at MoneyOwl, we will combine the best of human wisdom and technology, as well as stay true to an investing philosophy that combines both logic and evidence. You can let us take care of your investments, while you take care of important things like your health and well-being and enjoy purposeful activities with your family. If that includes music from BTS, enjoy them!