Note: It was announced in November 2023 that MoneyOwl will be acquired by Temasek Trust to serve communities under a re-purposed model, and will move away from direct sale of financial products. The article is retained with original information relevant as at the date of the article only, and any mention of products or promotions is retained for reference purposes only.

______________

While schools form the foundation of academic skills, financial savviness is a skill we usually pick up later in life. As parents, we act as life guides and role models for our children. Your child’s perspectives and attitudes toward money management come from you.

At MoneyOwl, we believe in the importance of financial literacy. Teaching your children about money matters from an early age can help them become more confident in their financial planning skills as they grow older.

This Children’s Day, we interview some of MoneyOwl’s staff to gather some insights on how they pass on their financial savviness to their owlets. Here is what they had to say:

An Early Headstart to Investing

Both my sons are aged 2 and 4, so I do the planning on their behalf. While parents mostly opt for endowment plans, I chose to open a MoneyOwl joint investment account with each of them and deposit their angpaos and birthday money into these accounts regularly.

I prefer the flexibility of not locking myself into an endowment plan. As both my children are young with many years ahead of them, I opt to invest in growth-focused portfolios to lock in better returns for the long run. By starting early and putting their money away in a well-diversified, low-cost equity fund such as MoneyOwl’s Dimensional fund, they can be looking at an average return of 6.7% each year.

MoneyOwl is the first robo-adviser in the market to offer straight-through joint investment account services to our clients as we saw its demand and benefits. The steps are very straightforward and can be done easily via our application.

I find the idea of being able to hand over a joint portfolio to them when they come of age deeply meaningful, and am glad to have kickstarted this investment journey with them!

Daryl Tan, Lead, Product Management and Technology

Teaching Them About Numbers And The Value of Things

With toddlers, parents can share early numeracy skills and teach them to value their things. For example, my daughter is nineteen months. While she has not learnt to count and can barely form words, she has magically learnt the power of negotiating. She does this by signing for one more story, one more piece of fruit, one more snack, and so forth. While preparing her formula milk, I sometimes ask her in jest, “How many scoops do you want?” She shows me five fingers.

I find that many activities we do count towards building numeracy skills, such as reading stories that show multiple objects or animals, counting her blocks, and singing songs with numbers and rhymes.

To prevent her from losing interest in her toys and books, we limit and rotate them so that she treasures every piece and spends more quality time with each. Less is more, in this instance!

Ng Shao Ru, Content Marketing Manager

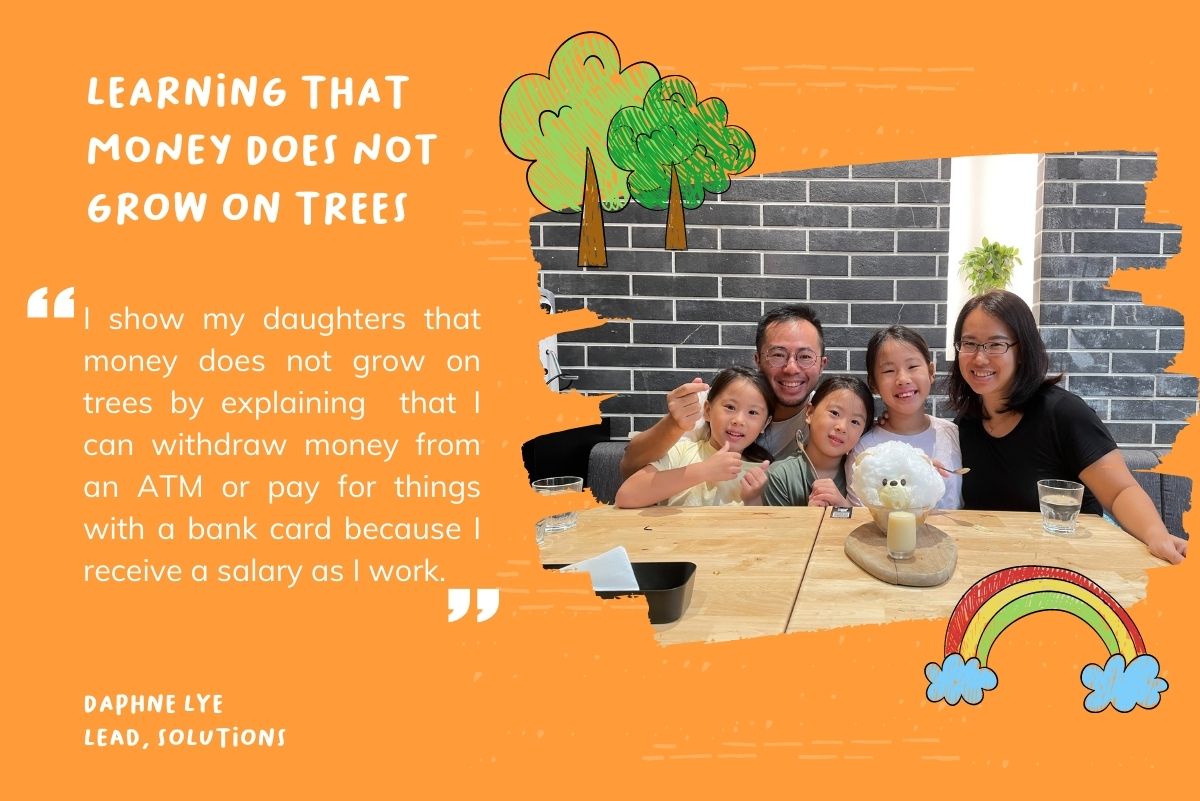

Learning That Money Does Not Grow on Trees

I believe having a good attitude towards money is an essential life skill. I show my daughters, aged 9 and 7, that money does not grow on trees by explaining that I can withdraw money from an ATM or pay for things with a bank card because I receive a salary as I work.

Similarly, I teach them the value of a dollar by comparing prices of similar items in a shop and choosing the cheapest one.

I also try to impress upon them the importance of saving by using their retired grandparents as examples. I will explain that gong gong and ah ma can stop working now because they had put aside money when they were younger.

Daphne Lye, Lead, Solutions

Having Conversations About Saving And Investing

I make it a point to impart values into my daily interactions with my son 14, and daughter, 9, instead of serious lectures. For example, whenever they receive a cash gift, my wife and I will ask them to count their money – and take the opportunity to introduce them the importance of saving for a future need.

Most of the time, we say ‘No’ to their request to buy new items. We find that doing so helps prevents impulse buys. Then, if they still need the item, we get them to justify if it is a need or a want. We discuss our purchases in front of them, so they know their parents follow the same principles.

Both my children know that I have invested their ang pao money for them, so the conversation has changed– they tell me to invest their money instead of just saving it up!

I explain to them how investing works in simpler terms. Companies that do well want to improve their business, so they seek investors’ money to grow the business. Over time, the price of a share we buy may increase if the company continues to do well, or fall, if they are unable to maintain a lead. My son is a car fanatic, so Tesla is the hottest company to him.

I also explain what MoneyOwl does differently with our portfolios. We invest in thousands of companies so that we benefit from the ones that do well and if some of them don’t, we will not be too badly affected since we have so many companies in our portfolio.

Colin Lai, CFP®, Lead, Client Advisory

Children’s Day Colouring Contest: Paint Your Future Together with MoneyOwl

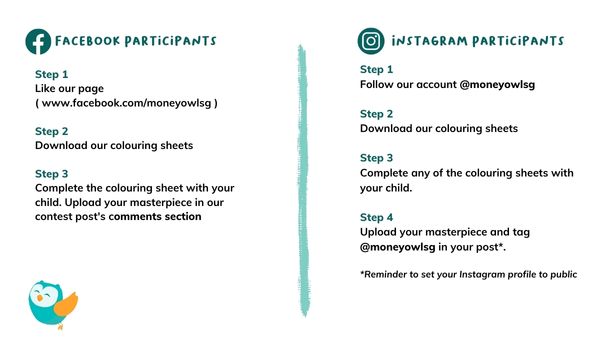

Teamwork makes the dream work, and that holds true when you create a joint investment account with your child so you can teach them about money matters. This Children’s Day, we are putting you and your child’s teamwork and creative skills to the test with a colouring contest. Stand to win a FREE Kiztopia X-tra pass (admits one child and one adult) for up to 10 lucky winners!

Here’s how to win:

The contest runs concurrently on our Facebook and Instagram channels and the deadline has been extended to 31 October 2359h. We will announce the winners by 4 November.

Head over to our Facebook or Instagram channels to participate!

Disclaimer: While every reasonable care is taken to ensure the accuracy of the information provided, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The information and opinions expressed herein are made in good faith and are based on sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Expressions of opinions or estimates should neither be relied upon nor used in any way as an indication of the future performance of any financial products, as prices of assets and currencies may go down as well as up and past performance should not be taken as an indication of future performance. The author and publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.

Follow MoneyOwl on social media for more awesome content on investments, insurance, and financial planning!